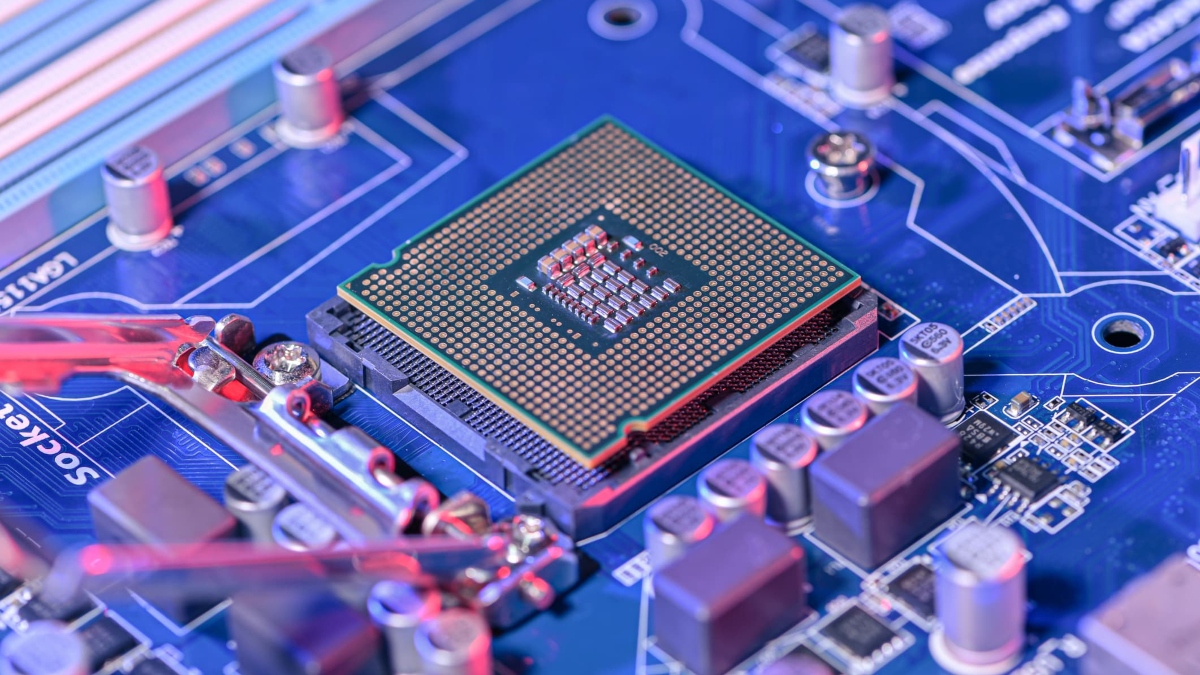

Many sectors from auto industry to consumer goods and smartphone manufacturers have incurred losses despite rising demand for products due to an acute shortage of semiconductors chips — used for manufacturing several goods including electronic products, vehicles, smartphones and other gadgets. The global chip supply crunch, which started after the pandemic in 2020, has intensified over the last few months and major companies across several industries are struggling to meet the rising demand for electronic goods and components.

Some key reasons behind the global chip shortage are supply chain disruptions due to the pandemic, a sharp rise in demand for electronic goods as more people are now working from home and lack of investment in chip building capacities. Patrick Armstrong, CIO of Plurimi Investment Managers, told that the chip shortage could last at least 18 months before the demand-supply equation normalises.

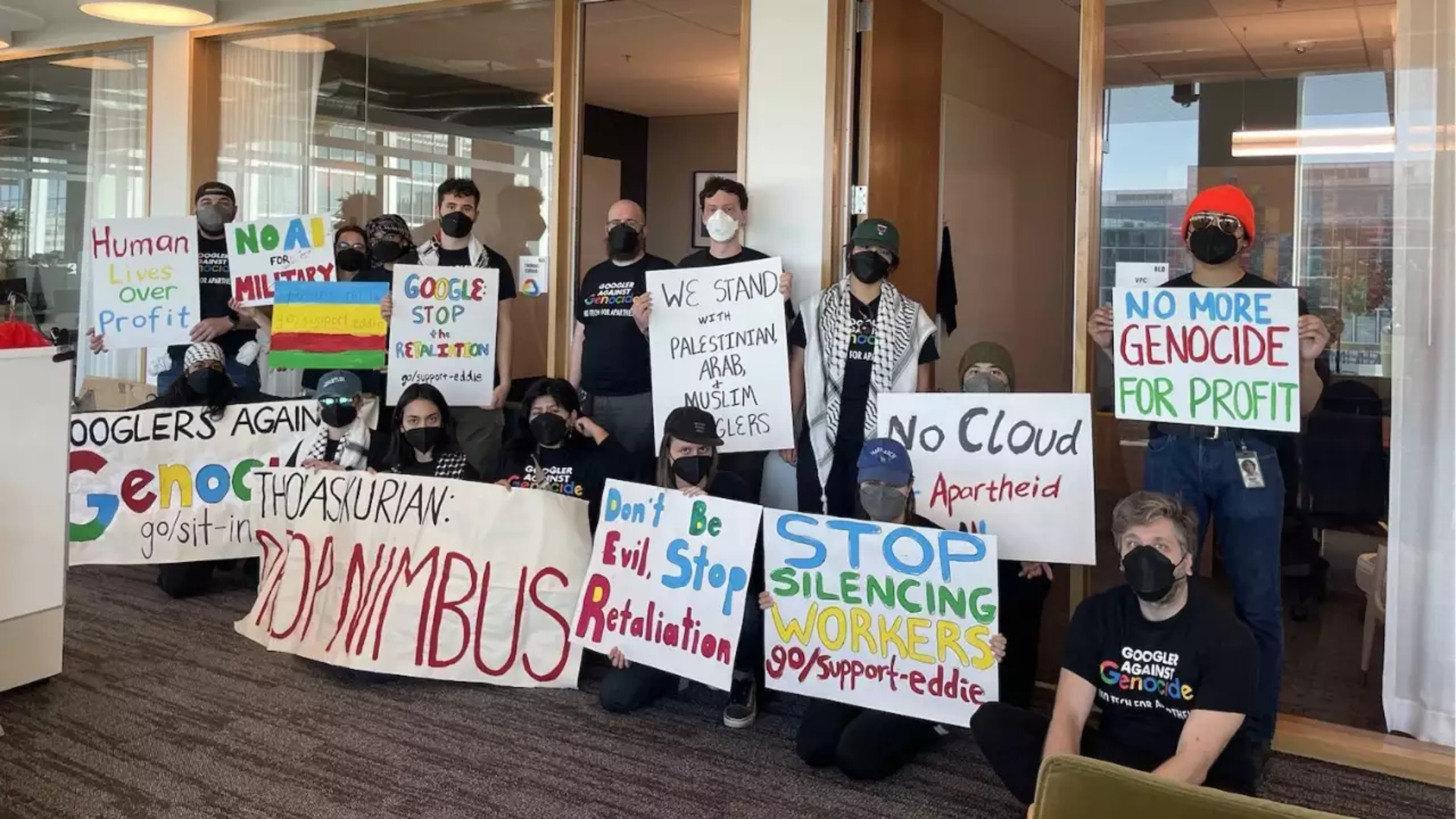

A U.K. lawmaker believes China is using questionable methods to ensure it becomes a world leader in semiconductor technology amid the crisis. Iain Duncan Smith, a member of parliament and the former leader of the Conservative Party, told the U.K. Parliament on Thursday that China has identified semiconductor technology as a key area it wants to dominate globally. The industry is currently led by Taiwan, South Korea and the U.S, which are home to chipmaking giants TSMC, Samsung and Intel respectively. China is “busy stealing technology, getting other people’s intellectual property rights, and buying up companies,” Duncan Smith said.

Chips are used to power everything from parking sensors in cars to sophisticated missile systems, but they’re currently in short supply and nations are taking steps to ensure they have enough of them. On July 5, Chinese-owned Nexperia confirmed its intensions to buy Newport Wafer Fab, the U.K.’s biggest chip manufacturer. Several other European chip firms — including Britain’s Imagination Technologies, France’s Linxens and the Netherland’s Ampleon — have been sold to state-backed Chinese firms in recent years.

The U.K. government initially said it has no plans to intervene in the Newport Wafer Fab acquisition, but last Wednesday Prime Minister Boris Johnson said the deal will be subject to a review by national security adviser Stephen Lovegrove. Duncan Smith said he thinks the government is in an “unwholly mess” in relation to the deal. “I wonder in the course of this failure to make a decision did they look at what China thinks of semiconductors?” he asked. “China is the busiest exporter in the world and is busy buying up semiconductor technology everywhere it can find it.”

Moreover, Beijing has been pressuring the Dutch government to allow its companies to buy ASML Holding NV’s marquee product: a machine that is essential to making advanced microprocessors. China wants the machines for domestic chip makers, so smartphone giant Huawei Technologies Co. and other Chinese tech companies can be less reliant on foreign suppliers. But ASML hasn’t sent a single one because the Netherlands—under pressure from the U.S.—is withholding an export license to China. The Biden administration has asked the government to restrict sales because of national-security concerns, according to U.S. officials.