Personal Loan Rate of Interest in India 2026: Bank vs Instant Loan App

Personal Loan Rate of Interest in India 2026: Bank vs Instant Loan App

Understanding borrowing costs is essential before applying for any loan. In 2026, the Personal loan rate of interest in India remains one of the most crucial factors that directly impacts your total repayment amount. While quick disbursement and minimal paperwork are attractive features, it is ultimately the interest rate that determines how affordable your loan will be.

Even a small variation of 3–4% in your interest rate can increase your total repayment by thousands of rupees over the loan tenure. That is why comparing the current Personal loan rate of interest in India before applying is a smart financial decision.

This blog will help you understand:

Personal loan interest rate trends in 2026

Bank vs instant loan app comparison

EMI calculation examples

Hidden charges that increase the loan cost

Ways to get the lowest personal loan interest rate

Personal Loan Interest Rate in India 2026: Current Market Scenario

Personal loan interest rates in 2026 are affected by borrower characteristics, online lending, and risk analysis techniques.

Typical Personal Loan Interest Rate Range

|

Lender Type |

Interest Rate Range |

Approval Time |

|

Traditional Banks |

10% – 15% |

2–5 days |

|

NBFCs |

14% – 24% |

1–3 days |

|

Instant Loan Apps |

18% – 36% |

Within hours |

Who Gets the Lowest Personal Loan Interest Rate?

Borrowers with:

Credit score above 750

Stable monthly income

Low existing EMI burden

Strong repayment history

These directly affect the personal loan interest rate that is applicable to you.

What Is Personal Loan Rate of Interest and Why Does It Matter

The personal loan rate of interest is the rate at which interest is charged on the borrowed amount every year. The majority of lenders follow the reducing balance method, which means that the interest is charged on the outstanding amount.

Real Example: EMI Comparison

Loan Amount: ₹5,00,000

Tenure: 36 months

|

Interest Rate |

EMI (₹) |

Total Interest Paid (₹) |

|

11% |

16,370 |

89,320 |

|

16% |

17,610 |

1,33,960 |

|

24% |

19,610 |

2,05,960 |

A borrower paying 24% instead of 11% will pay over ₹1 lakh extra in interest.

Before applying, it is always advisable to check the current personal loan rate of interest to know the total repayment amount

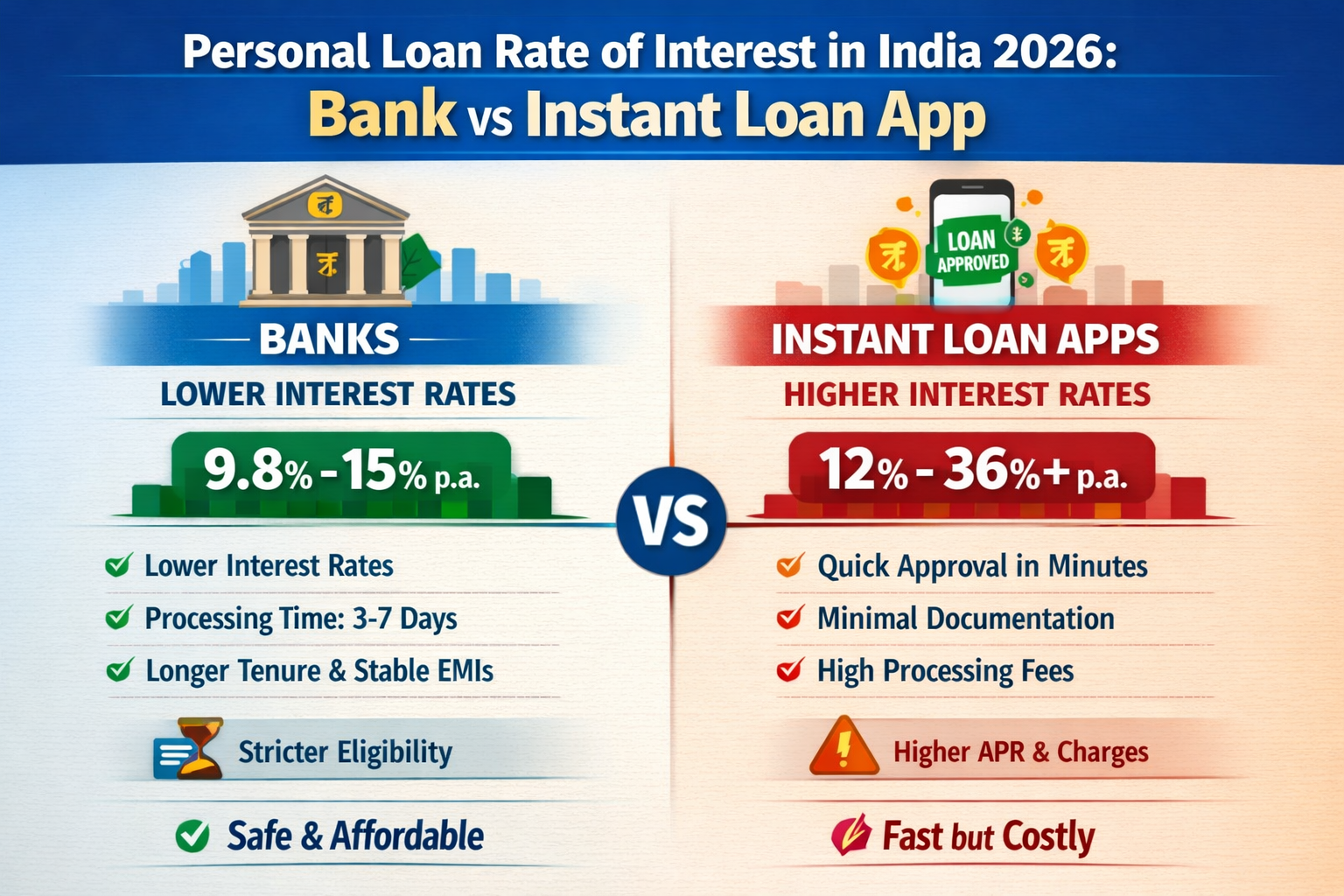

Bank vs Instant Loan App: Which One Provides a Better Personal Loan Rate of Interest?

The most important choice in 2026 is between banks and online lending platforms.

1️. Bank Personal Loan Interest Rate

Banks usually offer lower rates because:

They conduct detailed credit assessments.

They prefer salaried borrowers.

They evaluate income stability.

They operate under stricter lending norms.

However:

Documentation requirements are higher.

Approval may take longer.

2️. Instant Loan App Interest Rate

Instant loan apps focus on speed and convenience. Borrowers choose them for:

Fully digital process

Quick eligibility check

Fast disbursal

Minimal paperwork

However, since they process loans faster and even lend to moderate-risk clients, their interest rates are usually higher.

Platforms such as Olyv make online borrowing easier and provide instant access to money for short-term purposes.

If you are thinking of going this route, understanding how an instant personal loan app works will enable you to compare rates before applying

Hidden Charges That Increase Your Effective Interest Rate

Most borrowers are only concerned with the nominal interest rate. However, additional charges significantly increase the total cost.

Common Charges Include:

Processing fee (1% – 6%)

GST on processing fee

Prepayment penalty

Foreclosure charges

Late payment penalties

Insurance premium

For instance, a 14% loan with a 5% processing charge may end up costing much more.

Always calculate:

Entire repayment amount

Effective annual percentage rate (APR)

Net disbursed amount

Factors That Affect Personal Loan Rate of Interest

Knowing these variables can help you get the lowest personal loan interest rate in India.

Credit Score and Loan Interest Rate

Your credit score is the most crucial factor.

750+ → Best interest rates

700–749 → Moderate rates

Below 700 → Higher rates

Before applying, improving your credit score can go a long way in lessening your interest rate.

Income and Employment Stability

Lenders assess:

Monthly income

Job stability

Employer profile

Years of experience

Stable income signals lower risk.

Existing Loans and EMI Burden

Below are the variables that may be considered if your debt-to-income ratio is high:

Increase the interest rate.

Reduce loan eligibility

Offer shorter tenure

Managing existing liabilities improves negotiation power.

Real Borrower Scenario: Why Interest Rate Comparison Matters

Rahul has a credit score of 780 and a monthly salary of ₹65,000. And he applies for a ₹5,00,000 personal loan and gets an offer of 11.5%.

His colleague with a credit score of 690 gets an 18% offer for a similar loan amount.

Over 3 years:

Rahul paid approx ₹95,000 in interest.

His colleague paid approx ₹1.5 lakh in interest.

That’s a difference of close to ₹55,000 – purely because of the credit profile.

This is why it is so important to have a good credit profile.

How to Get the Lowest Personal Loan Interest Rate in 2026

Here are some practical strategies:

1️ Improve Credit Score

Pay EMIs on time

Credit utilization ratio should always be below 30%

Avoid multiple loan inquiries.

Maintain older credit accounts.

2️ Choose Shorter Loan Tenure

Shorter tenure:

Reduces total interest paid

Signals lower risk

Improves approval terms

3️ Compare Multiple Lenders

Never accept the first offer. Compare:

Interest rate

Processing fees

Prepayment conditions

Total repayment

4️ Borrow Only What You Need

Higher loan amounts will increase total interest liability. Responsible borrowing assures stability in long term financial growth.

FAQs – Personal loan rate of interest in India

What is the best & lowest personal loan rate of interest in India in 2026?

The interest rates may vary from lender to lender, but for people with good credit scores, the interest rates may be around 10%, this also depends on your profile.

Does credit score matter in personal loan interest rate?

Yes. A higher credit score will help you immensely in getting the lowest personal loan interest rate.

How To reduce my personal loan EMI?

You can have a lower EMI by choosing a bigger tenure, maintaining a credit score, or negotiating a lower interest rate.

Final Thoughts

The personal loan rate of interest in India 2026 depends highly on your credit profile, income criteria, and lender type.

Banks provide lower rate and stricter approval process

Instant loan apps are designed to provide speed and flexibility

Hidden charges increase effective loan cost

Total repayment amount is way more important compared to the interest rate.

You can save thousands of dollars in the future by making the right decision today.

Note: The Interest rates and examples shared above are indicative for 2026 and may differ based on individual eligibility and lender policies.

Rahul Chahar Announces Divorce From Wife Ishani Four Years After Marriage

Rahul Chahar made the announcement of his divorce on Instagram, pointing out that he spent…

The US Supreme Court struck down Donald Trump’s sweeping tariffs in a 6-3 ruling, declaring…

Rajasthan Royals will play four IPL 2026 home games in Jaipur after resolving issues with…