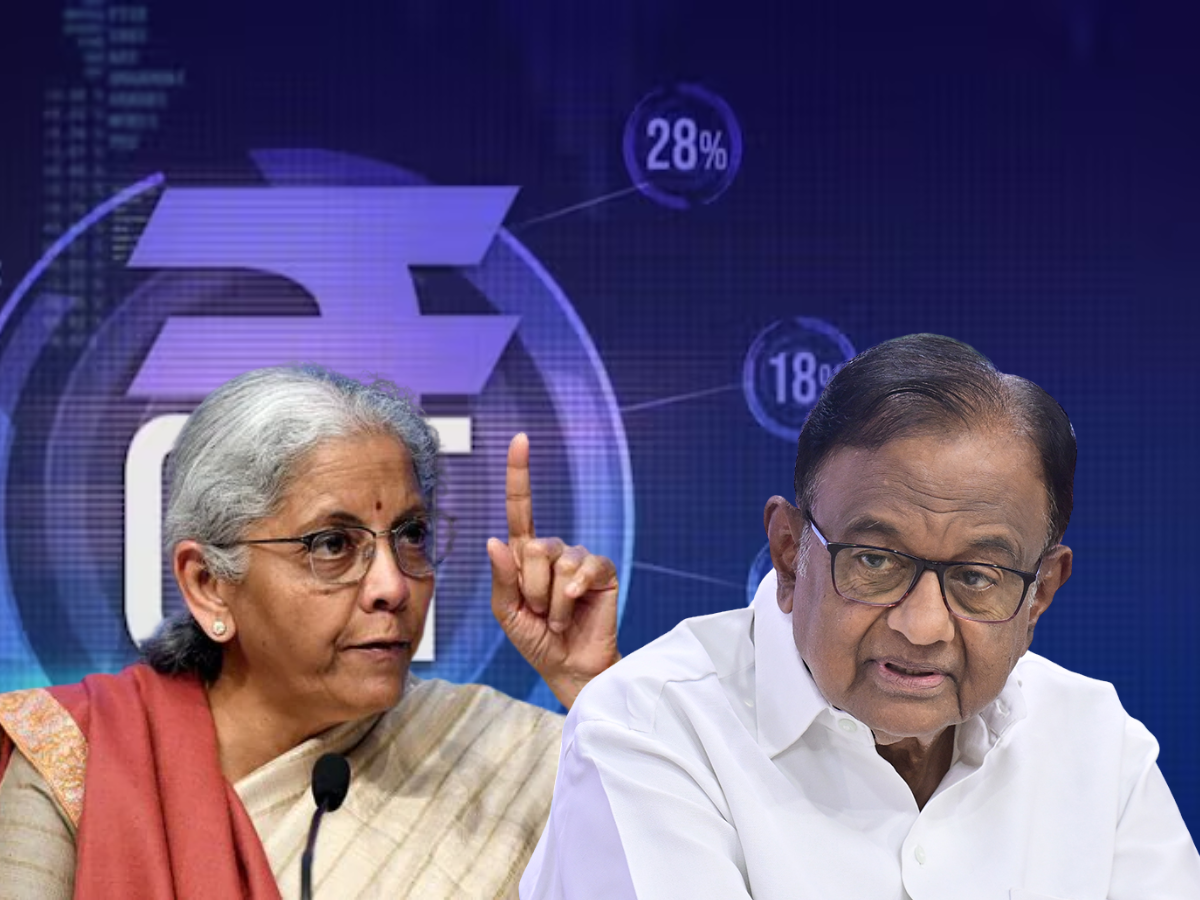

P. Chidambaram Questions Government On GST Reform

Former Finance Minister P. Chidambaram reacted strongly to the latest GST Council decisions on X. He said, “The GST rationalisation and the reduction in rates on a range of goods and services are WELCOME but 8 years TOO LATE.”

He criticised the original design of GST, adding, “The current design of GST and the rates prevailing until today ought not to have been introduced in the first place.” Chidambaram noted that his repeated warnings since the introduction of GST had not been considered by the government.

Chidambaram recalled that opposition leaders and economists who raised concerns about GST’s structure and rate slabs when the system was rolled out in 2017.

He said, “We have been crying hoarse for the last 8 years against the design and rates of GST, but our pleas fell on deaf years.”

He highlighted that the complex design and high rates burdened businesses and households. According to him, the Council’s decision to rationalise rates now reflects the same issues critics pointed out nearly a decade ago.

Chidambaram also speculated on what factors might have prompted the government to act now. He asked if the decision was driven by sluggish economic growth, rising household debt, falling household savings, or the upcoming elections in Bihar.

He further questioned if international developments, such as “Mr Trump and his tariffs,” also influenced the move. Listing these possible reasons, Chidambaram concluded with, “All of the above?” His remarks suggest doubts about the timing and motivation behind the reforms.

Must Read: 40% GST On Cigerettes But Only 18% GST On Bidis, Why Two Tobacco Products With Different GST Slab?

Swastika Sruti is a Senior Sub Editor at NewsX Digital with 5 years of experience shaping stories that matter. She loves tracking politics- national and global trends, and never misses a chance to dig deeper into policies and developments. Passionate about what’s happening around us, she brings sharp insight and clarity to every piece she works on. When not curating news, she’s busy exploring what’s next in the world of public interest. You can reach her at [swastika.newsx@gmail.com]

Samsung has confirmed AI-powered AR glasses for 2026, positioning them against Meta’s Ray-Ban smart glasses…

T20 World Cup 2026 Shock: Pat Cummins Ruled Out, Steve Smith Omitted — Check Australia’s Final Squad

Australia announced their 15 member squad on January 31st, with Mitchell Marsh named captain.

Chand Mera Dil: Producer Karan Johar is set to back a new film titled 'Chand…