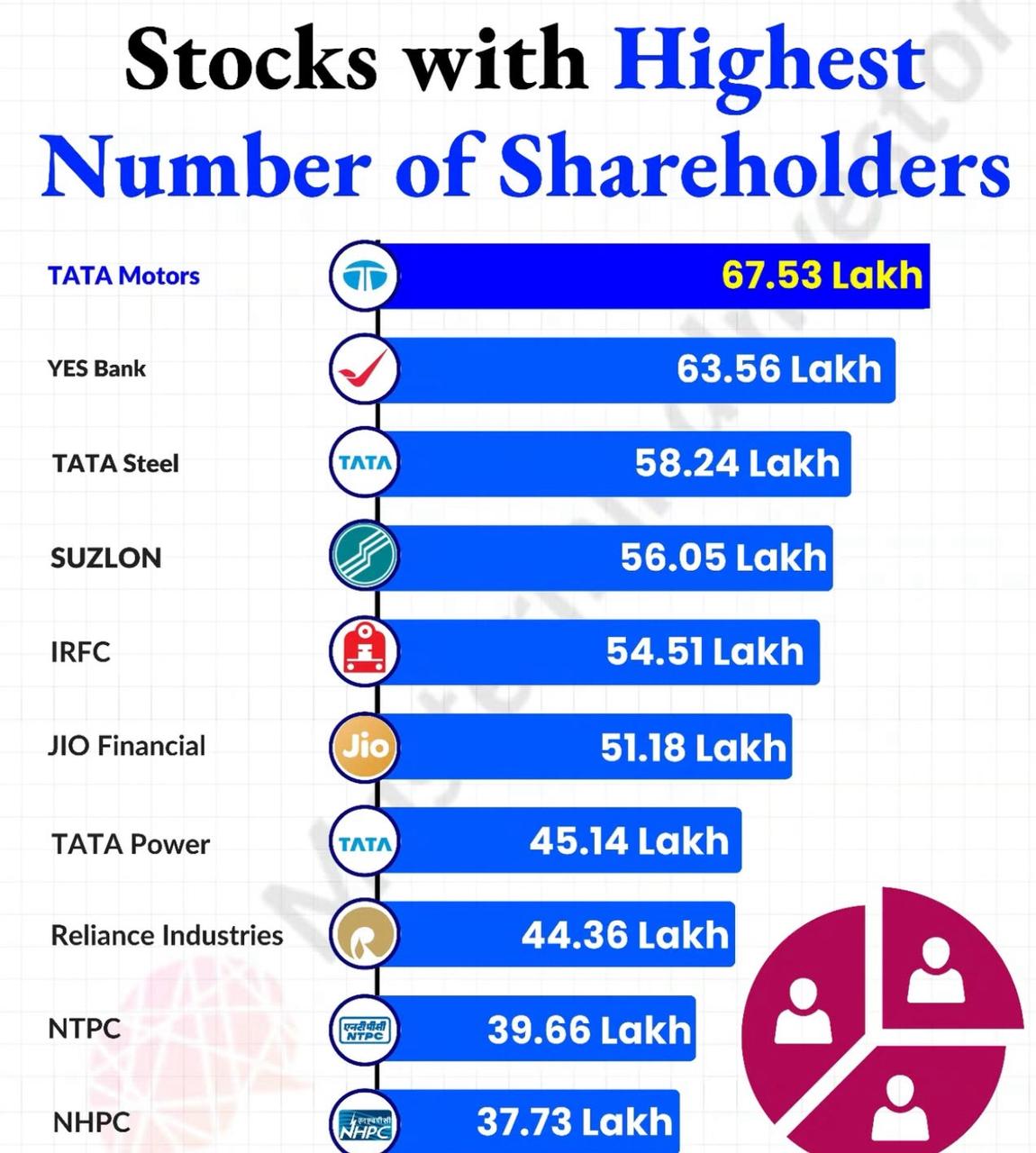

In a striking indicator of investor confidence and retail participation, Tata Motors has emerged as the company with the highest number of shareholders in India, boasting a remarkable 67.53 lakh investors. The latest data reflects a broader trend of increasing retail involvement in the equity markets, as millions of Indians diversify their investments into corporate stocks.

Coming on second is YES Bank, which commands 63.56 lakh shareholders. Despite its stormy past, the bank’s massive retail base indicates sustained interest, likely driven by its affordable share price and hopes of a complete turnaround. TATA Steel ranks third with 58.24 lakh shareholders, cementing the Tata Group’s dominance in attracting retail investors across multiple businesses.

Suzlon Energy, a renewable energy player, follows with 56.05 lakh shareholders, a testament to the growing investor appetite for green energy stocks. The Indian Railway Finance Corporation (IRFC) stands next with 54.51 lakh shareholders, reflecting public enthusiasm for railway-linked investments.

Jio Financial Services, a recent market entrant, already has 51.18 lakh shareholders, showcasing the magnetic pull of the Reliance brand. TATA Power, another Tata Group entity, features with 45.14 lakh shareholders, underlining retail investors’ bullish stance on the power sector. Reliance Industries itself, India’s largest company by market capitalization holds 44.36 lakh shareholders, balancing strong institutional ownership with a significant retail footprint.

Rounding out the list are two public sector giants: NTPC, with 39.66 lakh shareholders, and NHPC, with 37.73 lakh, highlighting the enduring appeal of stable, dividend-yielding PSU stocks.

The data underscores a notable fact: retail participation is not confined to just high-profile conglomerates, but extends across banking, green energy, infrastructure, and state-run enterprises. Tata Group companies alone occupy four positions in the top 10, collectively representing more than 2.15 crore shareholders.

Analysts point out that such widespread shareholder bases often indicate both strong brand loyalty and long-term retail investor trust. However, they also caution that a large shareholder count does not necessarily translate to superior stock performance. Investors are advised to balance enthusiasm with careful evaluation of fundamentals, market trends, and sectoral prospects.

With India’s equity markets continuing to attract first-time investors at record rates, the coming years may see even more diversification in shareholder distribution across emerging sectors.

Also Read: Gem Aromatics Limited IPO Alert: Should You Invest? Here’s What You Need To Know

From Death Rumours To Bail: Iran Releases Erfan Soltani After International Uproar – What Changed?

Iran has released 26-year-old protester Erfan Soltani on bail after global outrage and strong warnings…

Top US and Israeli military leaders held secret talks at the Pentagon amid rising tensions…

Grammy 2026: Big Nominations, Star Performances – When And Where Can You Watch Live In India

The 68th Annual Grammy Awards will be held on February 1, 2026, in Los Angeles,…