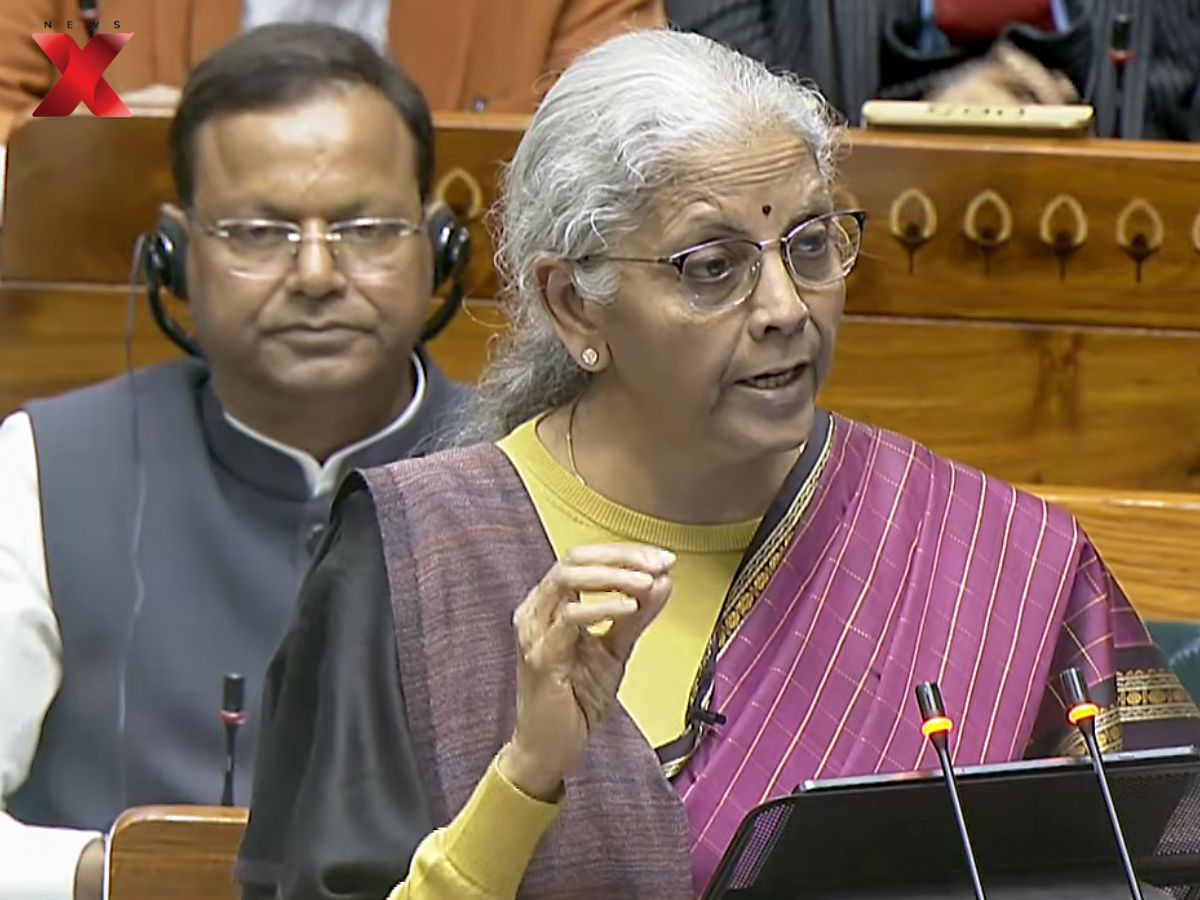

Union Budget 2026: Finance Minister Nirmala Sitharaman Announces IT Services Under Single Category, Boosts Tax Certainty (Photo:ANI)

Union Budget 2026: Union Finance Minister Nirmala Sitharaman on Sunday underscored India’s status as a global powerhouse in technology services, announcing key tax and policy reforms for the sector while presenting the Union Budget 2026-27 in Parliament.

Sitharaman said India is globally recognised for its strength in software development, IT-enabled services, knowledge process outsourcing, and contract research and development. To simplify taxation and compliance, she announced that all these segments will now be brought under a single classification called “Information Technology Services.”

“India is recognised as a global leader in software development services, IT-enabled services, knowledge process outsourcing, and contract R&D services. All these segments will be clubbed under a single category called Information Technology Services,” she said.

The Finance Minister announced a common safe harbour margin of 15.5 per cent for all IT services. She also proposed a sharp increase in the eligibility threshold for availing safe harbour provisions from ₹300 crore to ₹2,000 crore.

In a major compliance relief, Sitharaman said safe harbour approvals for IT services will be processed through an automated, rule-based system, eliminating the need for scrutiny by tax officers.

To further support the sector and attract global investors, the Budget reduced the processing time for Advanced Pricing Agreements (APAs) to two years, with a possible extension of six months. The facility of filing modified returns will also be extended to associated entities entering into APAs.

In a significant boost to digital infrastructure, Sitharaman announced a tax holiday till 2047 for foreign companies providing global cloud services through data centres located in India. The move is aimed at positioning India as a major global hub for cloud computing and data services.

(Via Agency Inputs)

Union Budget 2026-27 champions Nari Shakti, with record allocations, SHE-Marts, girls’ hostels, STEM upskilling, and…

During the Union Budget 2026 presentation, Finance Minister Sitharaman introduced the AI platform Bharat Vistaar…

During the Union Budget 2026 presentation, Finance Minister Sitharaman introduced the AI platform Bharat Vistaar…