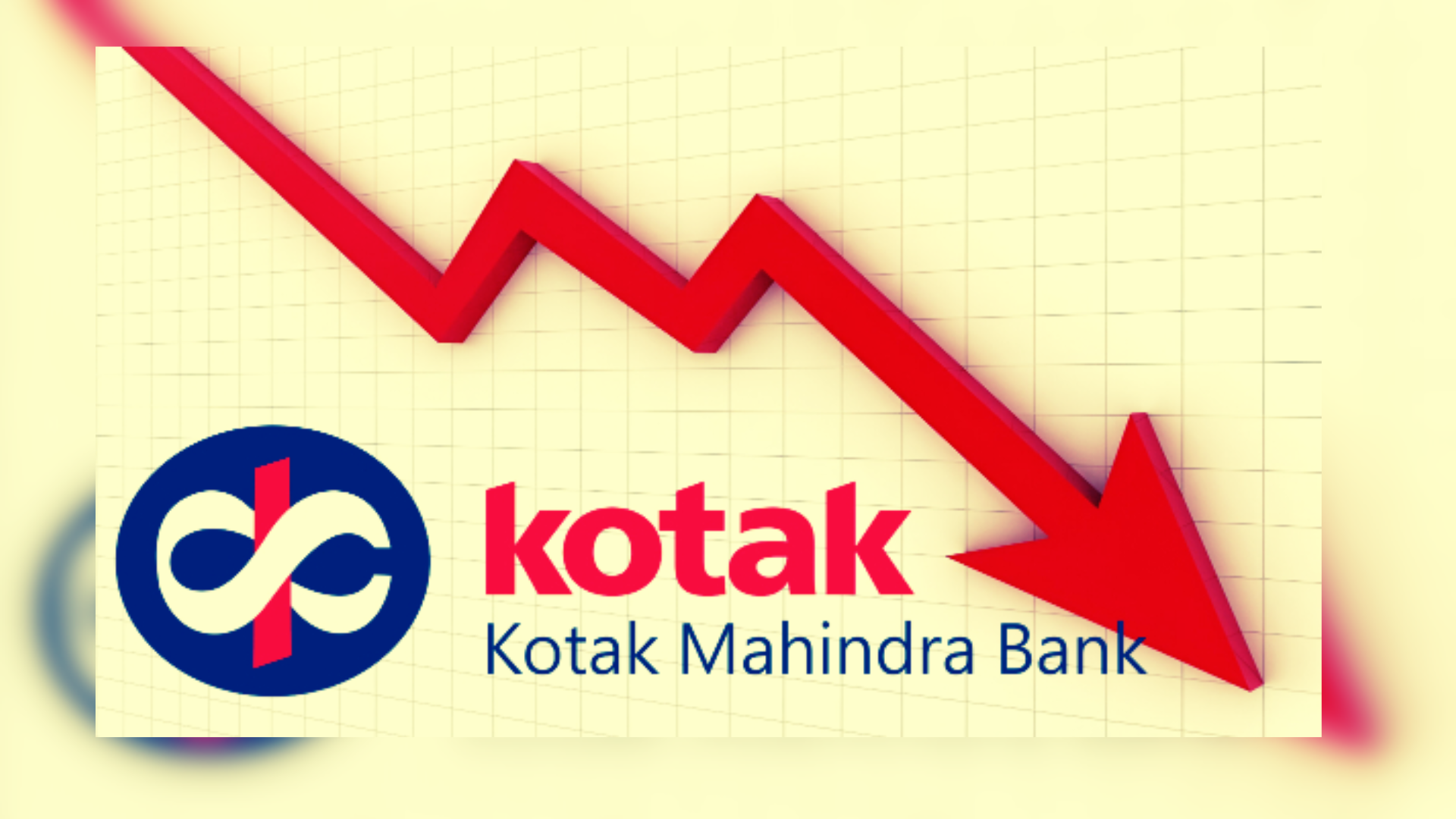

The Nifty index recently underwent a significant shift in its trading pattern, marked by a gap-down opening, subsequent gap-filling, and a notable break below the crucial 22,600 level. This series of events indicates a potential completion of wave (g) at the top of the market cycle.

Technical analysts and traders closely observed the development, noting that the breach of the 22,600 mark was a confirmation of a significant top formation. Additionally, the break of a key trendline and a sharp increase in Open Interest (OI) profiles further strengthened the argument for an important market peak.

Experts are now advising investors to utilize any pullbacks as selling opportunities, targeting immediate levels around 22,420 for a positional trade strategy. This approach aligns with the analysis suggesting a shift in market dynamics and a possible downward trend in the near term.

The observed patterns in Nifty’s movements, including the gap down, gap filling, and subsequent breach of crucial support levels, highlight the complexity and volatility of the current market environment. Traders and investors are urged to remain vigilant and adapt their strategies accordingly to navigate potential market shifts and capitalize on emerging opportunities.