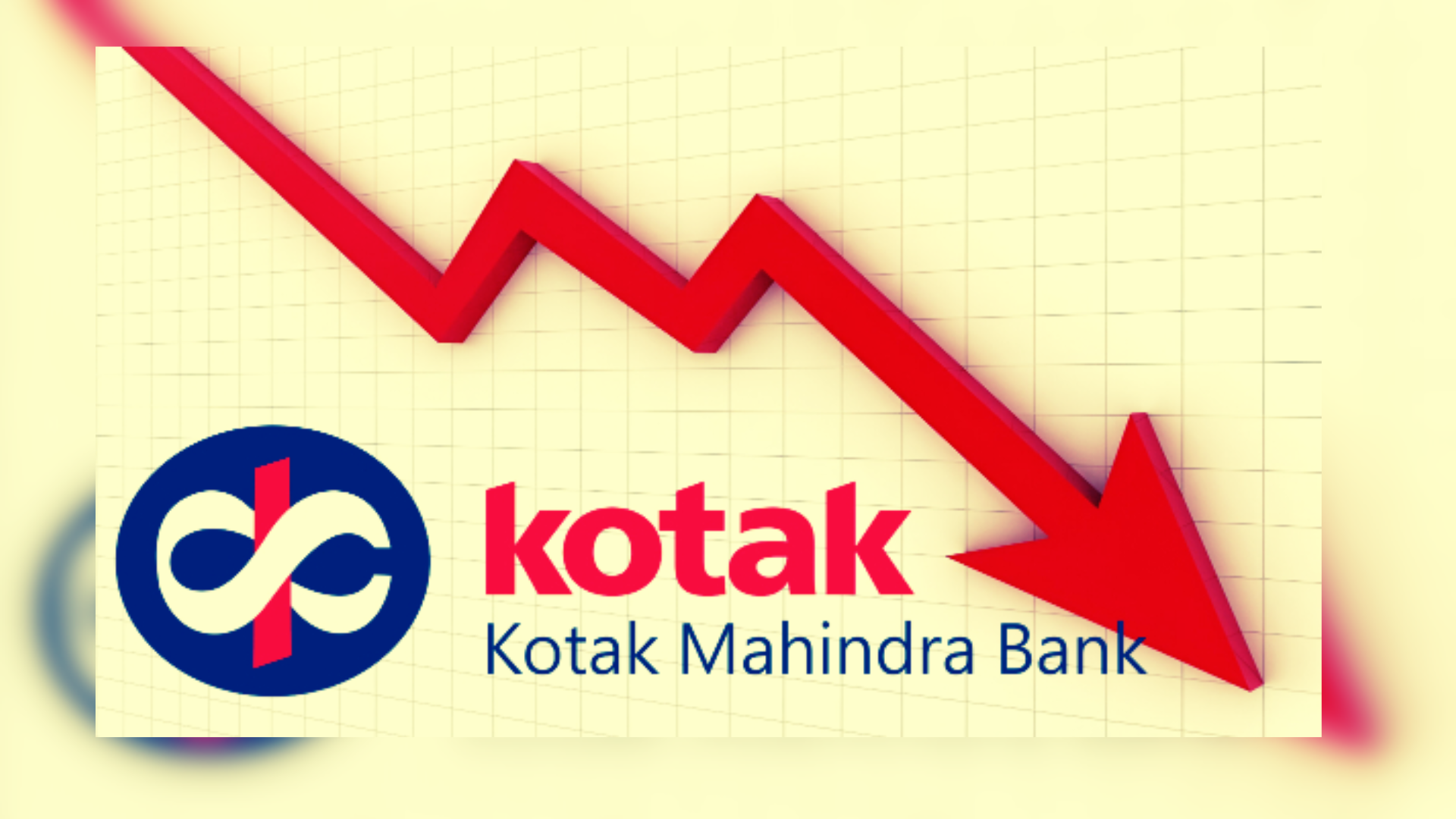

Kotak Mahindra Bank Ltd., founded and nurtured by Uday Kotak over decades, faced a significant setback as India’s banking regulator imposed unexpected restrictions on its digital operations, including the issuance of new credit cards. The development saw the bank’s shares plummet by as much as 13% on Thursday, marking one of the steepest declines in four years. As the largest shareholder with nearly 26% stake, Uday Kotak bore the brunt of the sell-off, experiencing a notable dip in his wealth, which contracted by $1.3 billion according to the Bloomberg Billionaires Index, leaving him with a net worth of $14.4 billion as of April 24.

The regulatory intervention dealt a blow not only to the bank but also to Uday Kotak personally, underscoring one of his most challenging tests yet in his illustrious career. Rival Axis Bank Ltd. surpassed Kotak Mahindra Bank in market capitalization for the first time since September 2016, driven by a surge in Axis’ shares following better-than-expected earnings performance.

The Reserve Bank of India (RBI) cited governance and risk concerns related to Kotak Mahindra Bank’s technology infrastructure as grounds for the ban. The central bank identified deficiencies and non-compliance in various operational aspects spanning two years, ranging from data security and leakage prevention strategies to vendor risk management. In response, Uday Kotak affirmed the bank’s commitment to adopting new technologies to bolster its IT systems and pledged cooperation with the RBI to swiftly address the identified issues.

READ ALSO : Lok Sabha Elections 2024: Preparations For Second Phase 1202 Candidates, 88 Constituencies

This is not the first regulatory hurdle Uday Kotak has encountered. Previously, he engaged in a legal battle with the RBI over his stake in the bank, ultimately agreeing to reduce his ownership in 2020 to resolve the dispute amicably. The recent developments underscore the regulatory challenges inherent in the banking sector, even for seasoned players like Kotak Mahindra Bank.

The timing of the regulatory action adds complexity to the situation, considering Uday Kotak’s recent transition to a new CEO, Ashok Vaswani, at the beginning of the year. Vaswani has emphasized the importance of scale for the bank’s growth trajectory and highlighted ongoing investments in technology to enhance operational efficiency and customer experience.

Uday Kotak’s journey from a modest investment company in 1985, initially funded by a 3 million rupee loan from family and friends, to the helm of one of India’s leading banks is a testament to his entrepreneurial vision and leadership. Over the years, he steered Kotak Mahindra Bank through various milestones, including ending a longstanding partnership with Goldman Sachs Group Inc. in 2006 to consolidate control over the bank’s operations.

The impact of the ban on digital customer acquisition is expected to reverberate across Kotak Mahindra Bank’s growth trajectory, particularly given its heavy reliance on digital channels for transaction volume. Analysts anticipate a negative sentiment in the short term, citing the potential slowdown in the bank’s expansion plans, especially in the absence of online customer acquisition avenues.

Despite the challenges posed by regulatory intervention, Uday Kotak’s legacy as a pioneering figure in India’s banking landscape remains intact. His resilience and strategic foresight will be crucial in navigating the bank through this period of uncertainty, reaffirming his status as one of Asia’s most influential bankers.