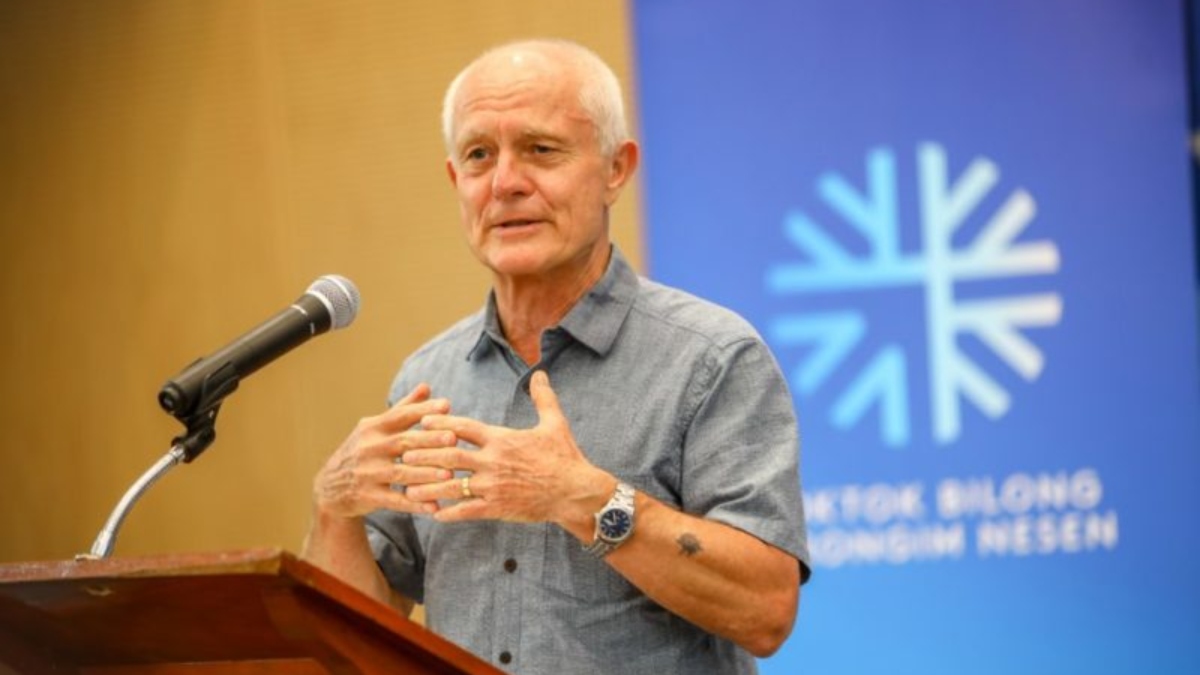

Professor Mick Moore, a highly acclaimed political economist and professorial fellow at the University of Sussex’s Institute of Development Studies believes that the ongoing crisis in Sri Lanka, which is the country’s worst in history, is a man-made problem because warning signs that had been visible for a year were ignored.

Moore claimed the Sri Lankan economic crisis is almost entirely caused by government policies that were highly imprudent in an interview with Amsterdam-based think tank European Foundation for South Asian Studies (EFSAS) last week. Moore discussed the current political and economic situation in Sri Lanka, as well as probable future trajectories, in the interview.

Sri Lanka is currently experiencing its worst economic crisis in recorded history, and this crisis, while the situation became worse by falling tourism revenues due to COVID-19 travel restrictions and rising food and fuel prices, was almost entirely caused by the Rajapaksa administration’s rash policy decisions.

Professor Moore explained that a rapid decline in national foreign exchange reserves has resulted in significant limits on the supply of imported common items, resulting in shortages of fuel, energy, food, and medicine.

According to the Professor, the reduction in foreign exchange reserves is the result of the government taking on an increasing amount of foreign currency loans without being financially competent of servicing the obligation.

Moore emphasized that the Rajapaksa government was not suddenly confronted with rising payment pressures, as it had been clear for more than a year that the country’s foreign exchange reserves would soon run out, and the country’s response to this looming balance of payments crisis had robbed the country of valuable negotiating time.

The majority of the debt was generated as a result of the government taking out large loans to fund politically popular domestic infrastructure projects that effectively encouraged rent-seeking behavior and patronage networks while making little economic sense.

However, talking about China’s role in Sri Lanka, Moore stated that it is important to note that China is not the only funding body in those projects, and thus the responsibility for the status quo is shared with other actors when discussing the role of Chinese investments in infrastructure and their alleged contribution to the country’s economic and political crisis.

The current unfavorable circumstances, he claims, are the outcome of debt accumulation, governmental errors, and ill-conceived infrastructure projects financed with Chinese funding.

Professor Moore went on to say that, given Sri Lanka’s geostrategic importance, rivalry for economic and political influence on behalf of foreign actors is unavoidable; hence, China’s engagement is not isolated.

Professor Moore responded to a question about long-term structural reforms by arguing that Sri Lanka’s long-term economic picture is not grim, since the country has profited enormously from Asia’s economic boom and new economic activity are growing.

When it comes to the fiscal problem, he believes that one possible answer would be to reverse the government’s recent tax cut reforms.