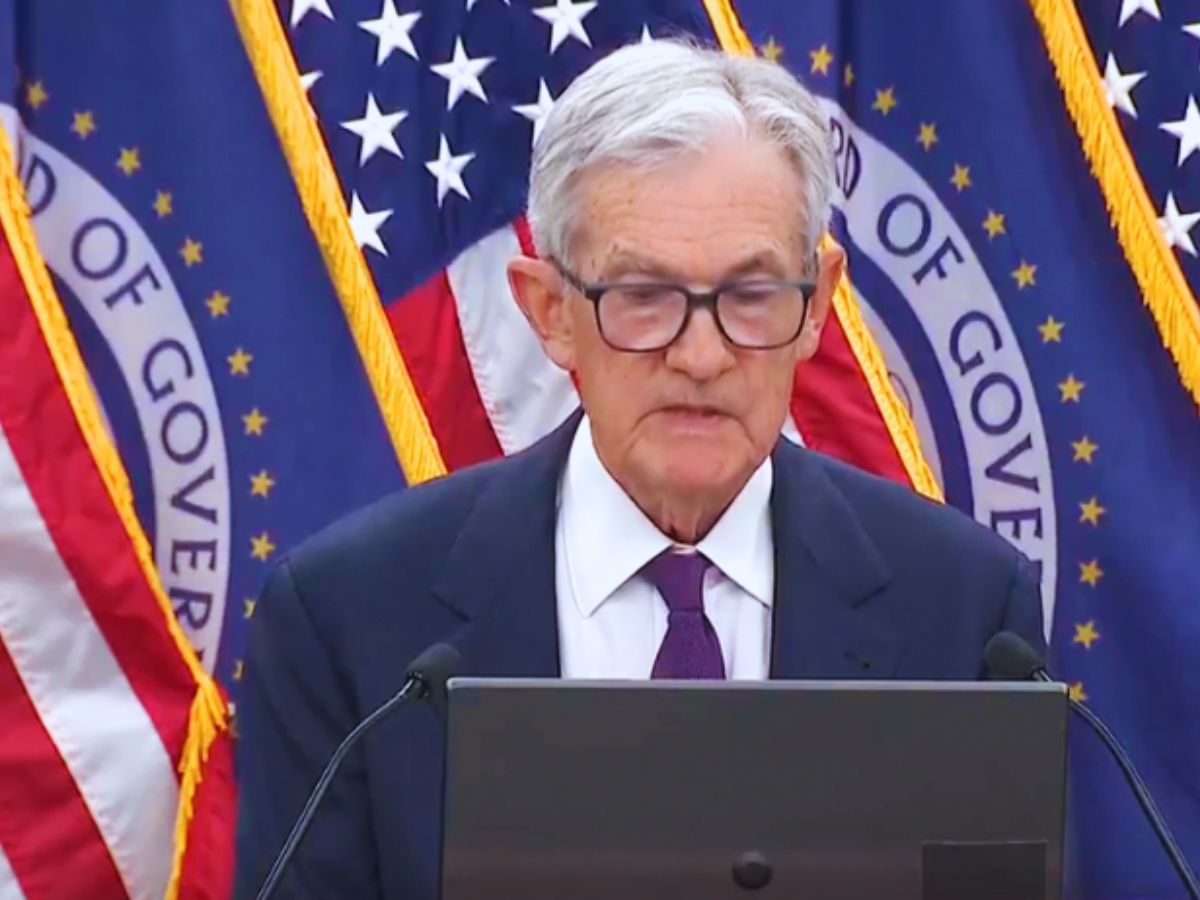

Jerome Powell-led FOMC keeps interest rates unchanged. (Photo: X)

The US Federal Reserve on Wednesday (January 28) decided to keep interest rates unchanged following its two-day policy meeting, signalling confidence in the strength of the American economy despite persistent inflationary pressures.

The decision, announced by the Federal Open Market Committee (FOMC) led by Fed Chair Jerome Powell, keeps the benchmark federal funds rate steady in the range of 3.5 per cent to 3.75 per cent.

In its post-meeting statement, the FOMC said it chose to maintain the current interest rate range “in support of its goals,” citing steady economic expansion and stable labour market conditions.

“The Committee decided to maintain the target range for the federal funds rate at 3-1/2 to 3-3/4 per cent,” the FOMC said, adding that policymakers continue to closely monitor inflation trends and employment data.

The federal funds rate serves as a benchmark for borrowing costs across the US economy, influencing everything from mortgages and credit cards to savings accounts and business loans.

Out of the 12 voting members on the committee, 10 voted in favour of holding rates steady, while Stephen Miran and Christopher Waller dissented.

Miran continued his streak of dissenting votes, while Waller’s opposition has drawn attention as he is widely viewed as a potential candidate to succeed Powell as the next Federal Reserve chair.

Addressing reporters after the announcement, Fed Chair Jerome Powell said recent data suggests the US economy remains resilient.

“Available indicators suggest that economic activity has been expanding at a solid pace,” Powell said. “Consumer spending has been resilient, and business fixed investment has continued to expand.”

However, Powell noted that the housing sector remains under pressure due to higher borrowing costs.

“In contrast, activity in the housing sector has remained weak,” he added.

Powell acknowledged that inflation remains above the Fed’s 2 per cent target but attributed much of the recent increase in goods prices to tariffs rather than excessive consumer demand.

“Most of the overrun in goods prices is from tariffs, and that’s actually good,” Powell said. “If it weren’t from tariffs, it might mean it’s from demand, which is a harder problem to solve.”

He added that tariff-related price increases are likely to be temporary, suggesting underlying inflation pressures remain manageable.

The FOMC noted that the US labour market remains strong, with unemployment showing signs of stabilisation. Powell reiterated that the Fed’s decisions continue to be guided by its dual mandate.

“Our monetary policy actions are guided by our dual mandate to promote maximum employment and stable prices for the American people,” he said.

Powell also pointed out that the temporary federal government shutdown may have weighed on economic activity in the previous quarter.

The Fed’s rate decision comes amid growing political scrutiny. US President Donald Trump recently said he may have narrowed his search for a new Fed chair, while the Justice Department has reportedly been investigating Powell raising concerns about the central bank’s independence.

Responding to questions on the issue, Powell said he remains confident.

“We haven’t lost it,” Powell said of the Fed’s independence. “I don’t believe we will. I certainly hope we won’t.”

With the Fed pausing rate hikes, yields on cash-based investments are expected to remain stable.

“Yields on savings products such as high-yield savings accounts and CDs are likely to remain unchanged for now,” said Stephen Kates, a certified financial planner at Bankrate.

Money market funds continue to attract investors, with the annualised seven-day yield on the Crane 100 index standing at around 3.5 per cent. One-year certificates of deposit currently offer returns ranging between 3.25 per cent and 4 per cent, depending on the issuer.

Powell also addressed geopolitical risks, particularly around energy markets, noting that oil prices have remained relatively subdued despite global turmoil.

On artificial intelligence-led job cuts, Powell said the Fed is closely monitoring developments.

“Large companies are hiring less or laying people off and often refer to AI when they do that,” he said. “It could certainly have significant effects on the economy and the workforce.”

Following the announcement, the US dollar held gains against major currencies including the euro and the yen, as investors reacted to the Fed’s steady stance amid strong economic growth and lingering inflation concerns.

Sofia Babu Chacko is a journalist with over five years of experience covering Indian politics, crime, human rights, gender issues, and stories about marginalized communities. She believes that every voice matters, and journalism has a vital role to play in amplifying those voices. Sofia is committed to creating impact and shedding light on stories that truly matter. Beyond her work in the newsroom, she is also a music enthusiast who enjoys singing.

Iran warns the US its forces have “fingers on the trigger” and will respond immediately…

Beating Retreat 2026: Delhi Police announces traffic restrictions & route diversions near Vijay Chowk, plan…

IND vs NZ: Shivam Dube’s 15-Ball Fifty In Vain As New Zealand Beat India By 50 Runs in 4th T20I

The southpaw Dube flickered brightly with a blazing half-century but it was insufficient to prevent…