Insurance Laws (Amendment) Bill, 2025 Tabled in Lok Sabha- “Sabka Bima Sabki Raksha”

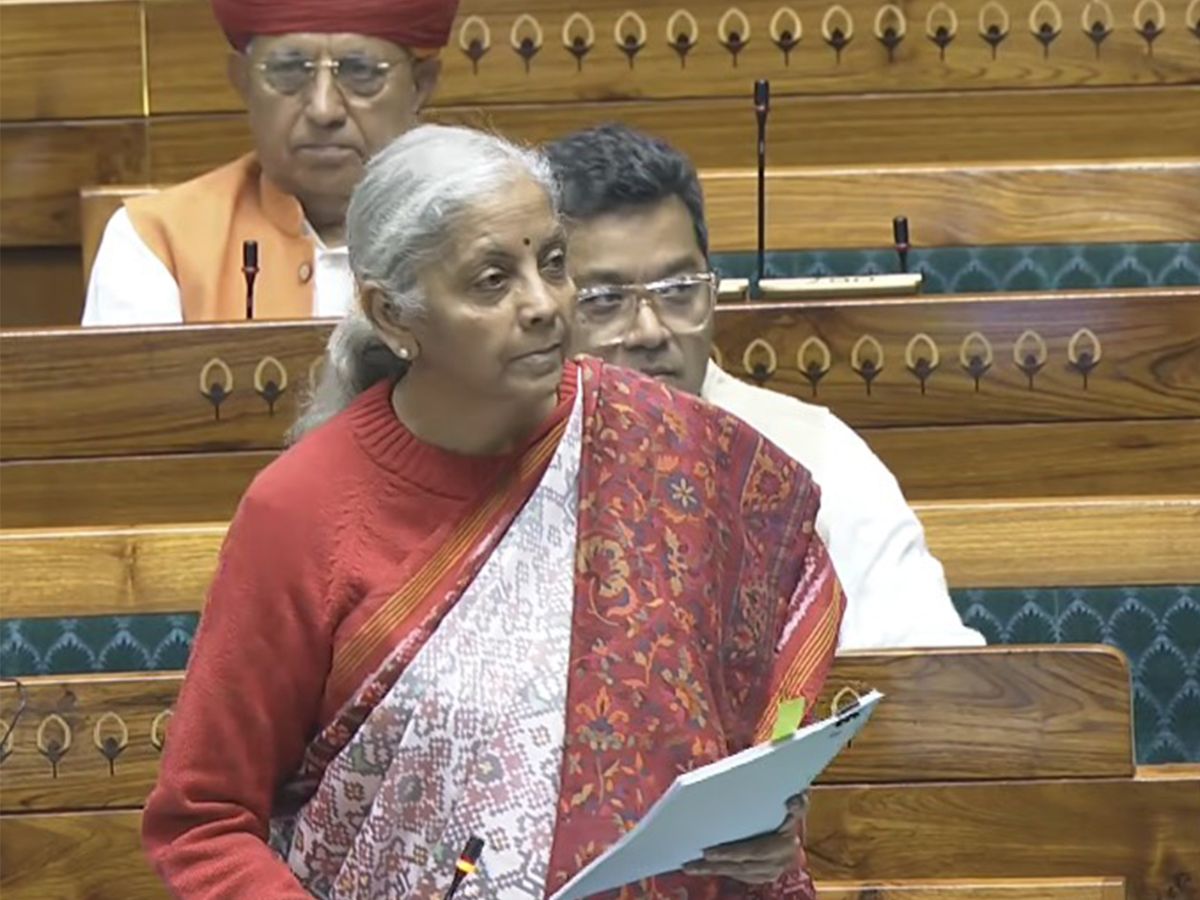

On Tuesday, Finance Minister Nirmala Sitharaman brought a lot of good news to Parliament by presenting the Insurance Laws (Amendment) Bill, 2025, which has been very well named “Sabka Bima Sabki Raksha”, in the Lok Sabha. Through the proposed law, millions of Indian citizens will be able to access the insurance market not only more easily but also in a stronger and more intelligent way.

The Bill, with its emphasis on the protection of policyholders, the expansion of insurance coverage, and the provision of a stimulus to the sector, gives the impression of a futuristic scenario where insurance is no longer a luxury but a basic safety net for everyone. The government, through investment encouragement, rule simplification, and trust-building, is looking to accelerate its ambitious goal of Insurance for All. This could be a significant step forward for both consumers and the industry.

Key Highlights Of The Insurance Laws (Amendment) Bill, 2025

- Amendments to Core Insurance Laws:

The Bill proposes changes to the Insurance Act, 1938, the Life Insurance Corporation Act, 1956, and the IRDAI Act, 1999, aligning reforms with the vision of Insurance for All by 2047 and improved ease of doing business. - Stronger Policyholder Protection:

A Policyholders’ Education and Protection Fund is proposed to boost insurance awareness and safeguard consumer interests. IRDAI will also be empowered to disgorge wrongful gains from insurers and intermediaries. - Digital Insurance Push:

A legal framework for digital public infrastructure will support innovation while prioritising data security, privacy, and cybersecurity for policyholder information. - Ease of Doing Business Measures:

The Bill proposes one-time registration for intermediaries and raises the IRDAI approval threshold for share transfers from 1% to 5% of paid-up equity, streamlining business operations.

100% FDI: A Game-Changer for India’s Insurance Landscape In The Insurance Laws (Amendment) Bill, 2025

The increase of the FDI limit in the insurance sector to 100% is certainly the most significant point of the Bill and is interpreted as the government’s strong support for the Indian insurance market. The government is allowing foreign investors to come in easily, which means that the long-term global capital, advanced technology, and global best practices are coming in the first place.

It could mean for policyholders better products, quicker services, and more extensive coverage. For the industry, it indicates new growth, tougher competition, and greater innovation. In a word, this move could fast-track insurance penetration and reinforce the social security net in India, which is great news for investors and citizens alike.

The Expected Impact of the Bill: All Insurance!

The insurance sector is going to be overhauled by the Insurance Laws (Amendment) Bill, 2025. The Bill is projected to widely open up insurance coverage, thereby putting more people in the loop to be taken care of in case of an eventuality. Apart from this, the faster growth of the sector as well as better protection for the policyholders are some of the things that are already being talked about, meaning your insurance experience could soon be smoother, smarter, and more secure.

Raising the Bar in Regulatory Governance: A Process that is Clear, Fair, and Transparent

The Bill proposes the setting up of a Standard Operating Procedure (SOP) for making regulations under the IRDAI Act. The phase of being in doubt is now over! A patent and reasonable penalty structure with specified handling standards is going to make the ruling fair and thus win over the trust of both the investors and the policyholders, showing that the laws are no longer for the dead.

Reducing the Cost of Doing Business: Insurers are In for a Treat

A one-off registry would be the gift that keeps on giving to insurance brokerages as it would mean a lower amount of filing with the authorities. There will be no more waiting for the IRDAI’s nod on share transfers provided they are under 5% of the paid-up equity. Smoother operations and faster decision-making are what you can expect.

The Digital Drive: i.e., Insurance Tech-Savvy

The Bill is poised to facilitate digital public infrastructure in insurance with a focus on data security, privacy, and cybersecurity. Policyholders reap the benefits of the cutting-edge services without compromising their security in any way as the reinforcements come with them.

The Bill is doing a great job of preparing the ground for a government-approved insurance sector in India, which would be more customer-friendly, transparent, and technology-savvy than ever before.