What is RuPay?

RuPay is a multilateral payment service system launched in India in 2014. It serves as an alternative to international payment networks like Visa and Mastercard, aiming to promote a domestic, open, and secure payment infrastructure within India.

When was RuPay launched in Abu Dhabi?

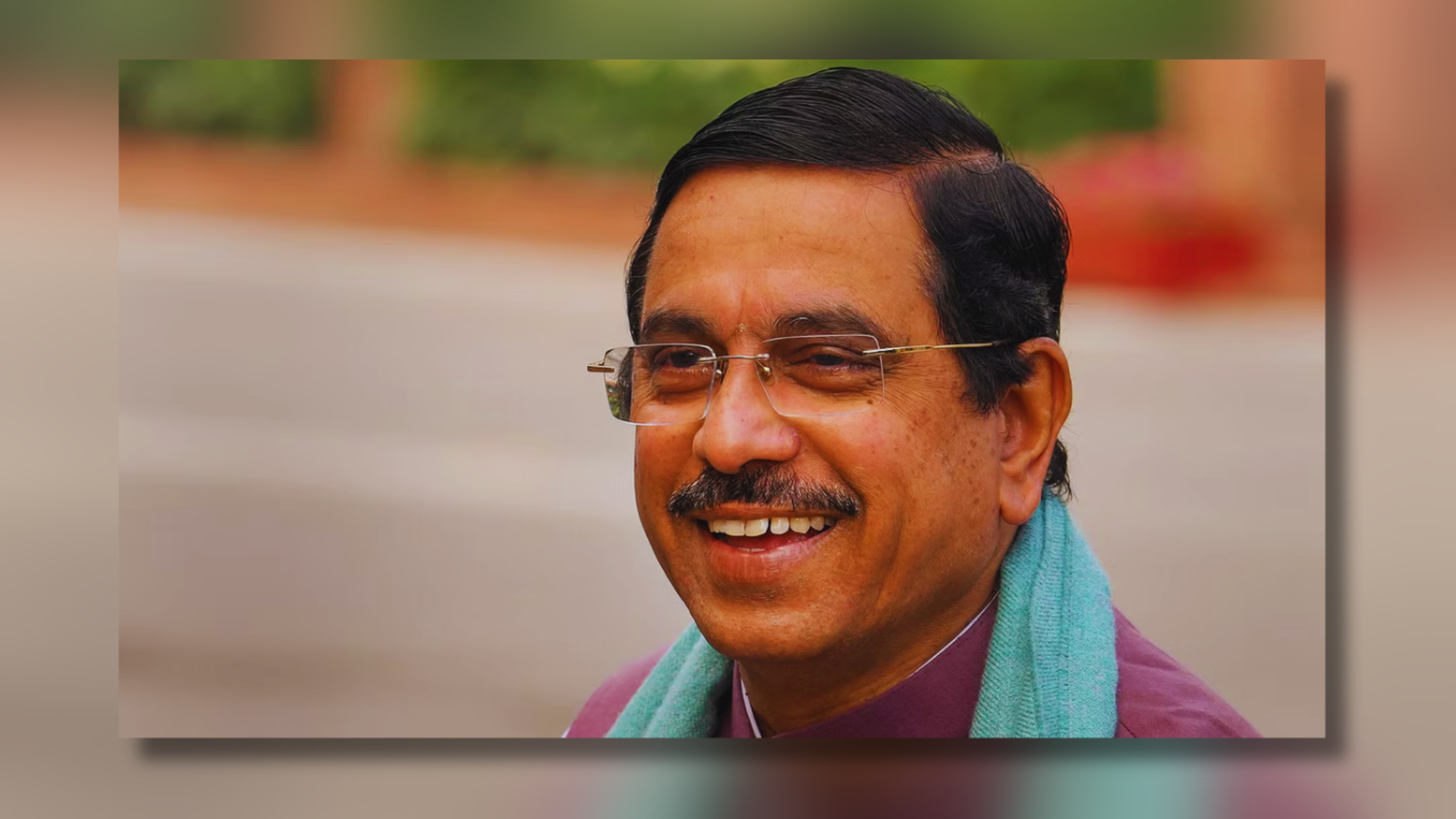

The official launch of the RuPay card in the UAE took place on August 24, 2019, at the Emirates Palace in Abu Dhabi, with Prime Minister Narendra Modi in attendance. This significant event is poised to bolster India’s business endeavors and support its diaspora in the affluent Gulf region.

The UAE stands as the inaugural Gulf nation to embrace the Indian RuPay card. During the launch, Prime Minister Modi demonstrated the card’s functionality by using it to purchase Indian sweets. His visit to the UAE falls between bilateral talks in Paris and the G-7 Summit in Biarritz.

Flourishing Partnership:

India and the UAE boast a flourishing FinTech relationship, driven by various factors like:

1- Strong bilateral ties: Both countries share close political and economic ties, establishing a foundation for FinTech collaboration.

2- Thriving FinTech ecosystems: India is the world’s third-largest FinTech ecosystem, while the UAE aims to become a global FinTech hub. This synergy creates significant opportunities.

Image of India FinTech ecosystemOpens in a new window

3- Focus on innovation: Both nations prioritize FinTech innovation, fostering an environment for collaboration and knowledge sharing.

Recent Agreements

RECENT AGREEMENTS:

Memorandums of Understanding (MoUs) on trade settlement and payment systems were signed in 2023, aiming to:

1- Boost trade: The use of national currencies (rupee and dirham) in cross-border transactions will be encouraged.

Improve payment efficiency: Linking India’s Unified Payments Interface (UPI) and the UAE’s Instant Payments Platform (IPP) will facilitate faster and cheaper cross-border payments.

Image of India UPIOpens in a new window

2- Increase card acceptance: Acceptance of RuPay and UAESWITCH cards for ATM withdrawals and point-of-sale purchases will be enabled.

Image of UAESWITCH cardOpens in a new window