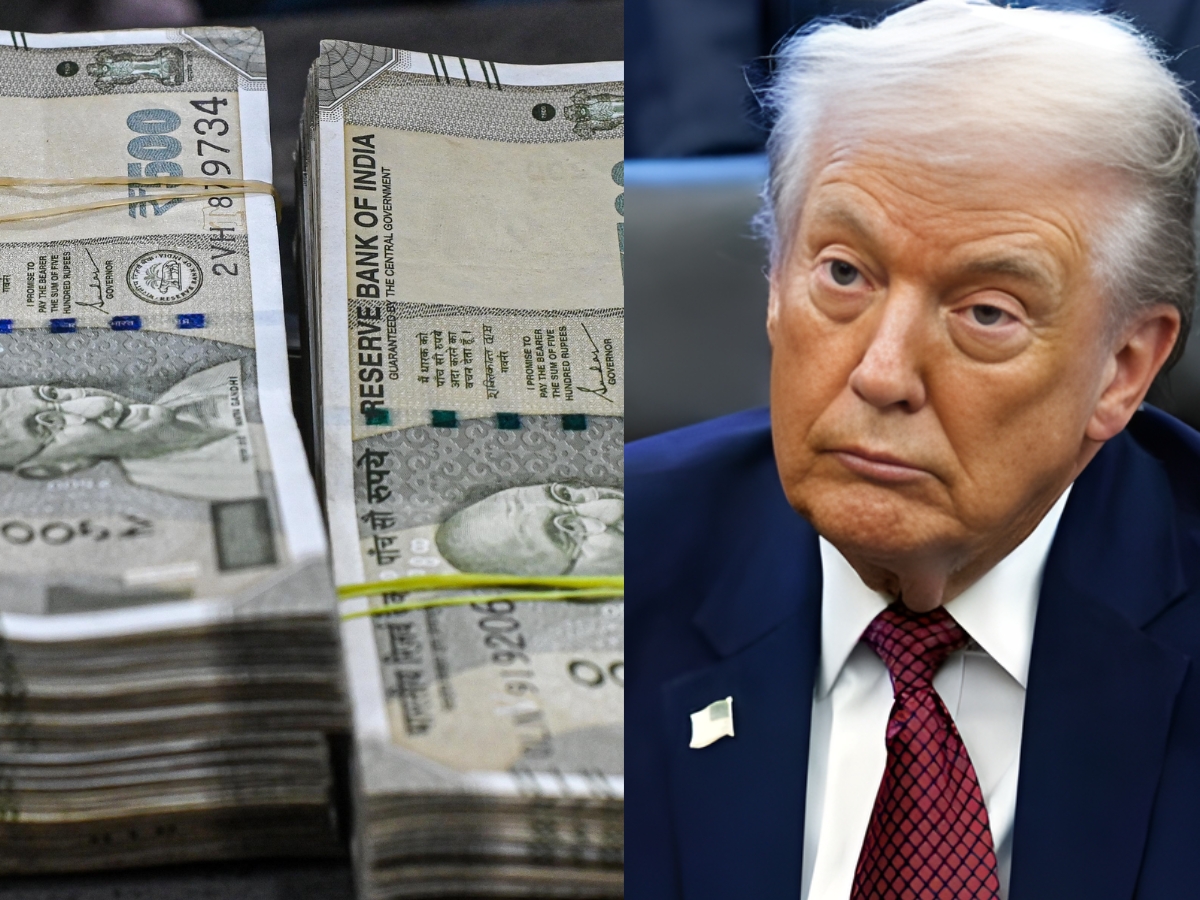

Rupee slides to record low as U.S. tariffs, trade deficits, and investor outflows hit Indian markets hard in 2025. Photos: X.

No currency has been hit harder by U.S. tariffs than India’s rupee – and there may yet be more downside as investors pull out of the country until they see a trade deal struck with Washington.

The rupee INR is among the worst-performing currencies globally this year, sliding 6% against the dollar as a widening trade deficit, punitive 50% U.S. tariffs and investment outflows have dragged it to a record low of 91.075 per dollar.

Measured against a basket of trading-partner currencies, the real effective exchange rate of 96 is the lowest in more than a decade, according to Citi. That is well below a decade average of 103, and a usually reliable signal that it is overdue for a rebound.

But this time is different, according to money managers who have driven pressure on the currency by pulling a record $18 billion from Indian equities this year and say the mood is unlikely to reverse quickly, even though the rupee looks cheap.

“I think the market’s patience in general is running thin,” said Vivek Rajpal, Asia macro strategist at investment advisory firm JB Drax Honore, as months of trade talks with the U.S. have so far yielded no deal or tariff relief.

It is a good entry point for Indian assets, he said, but first the market needs confidence that the tariffs are only temporary.

India and the U.S. have been engaged in negotiations through much of 2025, although India’s Chief Economic Advisor said in a Bloomberg interview last week that he expects an agreement to be reached by March 2026.

Still, much of Asia already has agreements or at least moratoriums in place with the U.S., leaving India especially exposed and the rupee as the shock absorber.

A falling currency can soften the blow of tariffs by reducing dollar prices for exports. But at 50% the U.S. levies are so high that economists expect more weakness in the rupee is needed to offset them, plus there is extra pressure on the currency from a relatively wide trade deficit and portfolio outflows.

Absent a trade deal, none of those factors are seen reversing in the near term and a Reuters report that the central bank does not plan on standing in the way of fundamentals has reinforced expectations of further weakness.

HSBC analysts said the sharp rupee depreciation is a significant risk to an otherwise encouraging setup for Indian stocks, which they argued are worth revisiting thanks to improving valuations and economics. They also see Indian markets as a hedge against the AI rally.

Other brokerages including Citi, Goldman Sachs and JP Morgan have also upgraded Indian equities in recent weeks, expecting a turn in the Indian market’s fortunes in 2026 with a boost from rate cuts and, to be sure, some eye a rebound in the rupee.

“The recent pace of depreciation has been driven partly by geopolitical risk and its influence on current account expectations,” said London-based Jean‑Charles Sambor, head of emerging markets debt at TT International Asset Management, with over $5 billion in assets under management.

“We believe some of this risk may be now overstated,” Sambor said. He declined to disclose positioning and neither performance nor flows suggest investors are snapping up rupees.

Indian equity markets, dominated by banks and IT outsourcing firms, have also lagged peers in 2025, with the benchmark Nifty 50 .NSEI up about 10% so far compared to a 26% gain in the MSCI Emerging Market Index .MSCIEF, hurt by a lack of clear AI bets.

In dollar terms, comparisons are even more unfavourable with MSCI’s India equities index .dMIIN00000PUS rising less than 2% this year against a near 30% rise in MSCI’s China index .dMICN00000PUS, a rival for foreign investors’ allocations.

Investors are also turning to China’s experience in U.S. President Donald Trump’s first term in office, for a guide on how far the rupee could fall.

Jitania Kandhari, deputy chief investment officer of the solutions and multi-asset group at Morgan Stanley Investment Management likened the fall in rupee to the Chinese yuan’s depreciation due to the U.S.-China trade tensions during Trump’s first term, and said the rupee may need to keep weakening if the tariffs stay in place.

The yuan declined about 12% between March 2018 and May 2020 due to a series of tit-for-tat tariff announcements.

Her firm, which manages $1.8 trillion in client assets, maintains an overweight position on Indian stocks even though it has trimmed holdings, finding value elsewhere.

“Depreciation of the rupee is necessary to improve the competitiveness of the Indian exports,” said Kunjal Gala, head of global emerging markets at Federated Hermes, who has been underweight on India since the start of 2024.

“However, a depreciating rupee creates a dilemma for global investors who are indexed to the dollar.”

(Except for the headline, all content in this article is sourced from Reuters news feed.)

Zubair Amin is a Senior Journalist at NewsX with over seven years of experience in reporting and editorial work. He has written for leading national and international publications, including Foreign Policy Magazine, Al Jazeera, The Economic Times, The Indian Express, The Wire, Article 14, Mongabay, News9, among others. His primary focus is on international affairs, with a strong interest in US politics and policy. He also writes on West Asia, Indian polity, and constitutional issues. Zubair tweets at zubaiyr.amin

AO 2026: Carlos Alcaraz bounced back from a set down to defeat Novak Djokovic and…

FM Nirmala Sitharaman says 21st century driven by tech will benefit common man; hits back…

India on Sunday rejected Pakistan’s claims linking it to violence in Balochistan, calling the allegations…