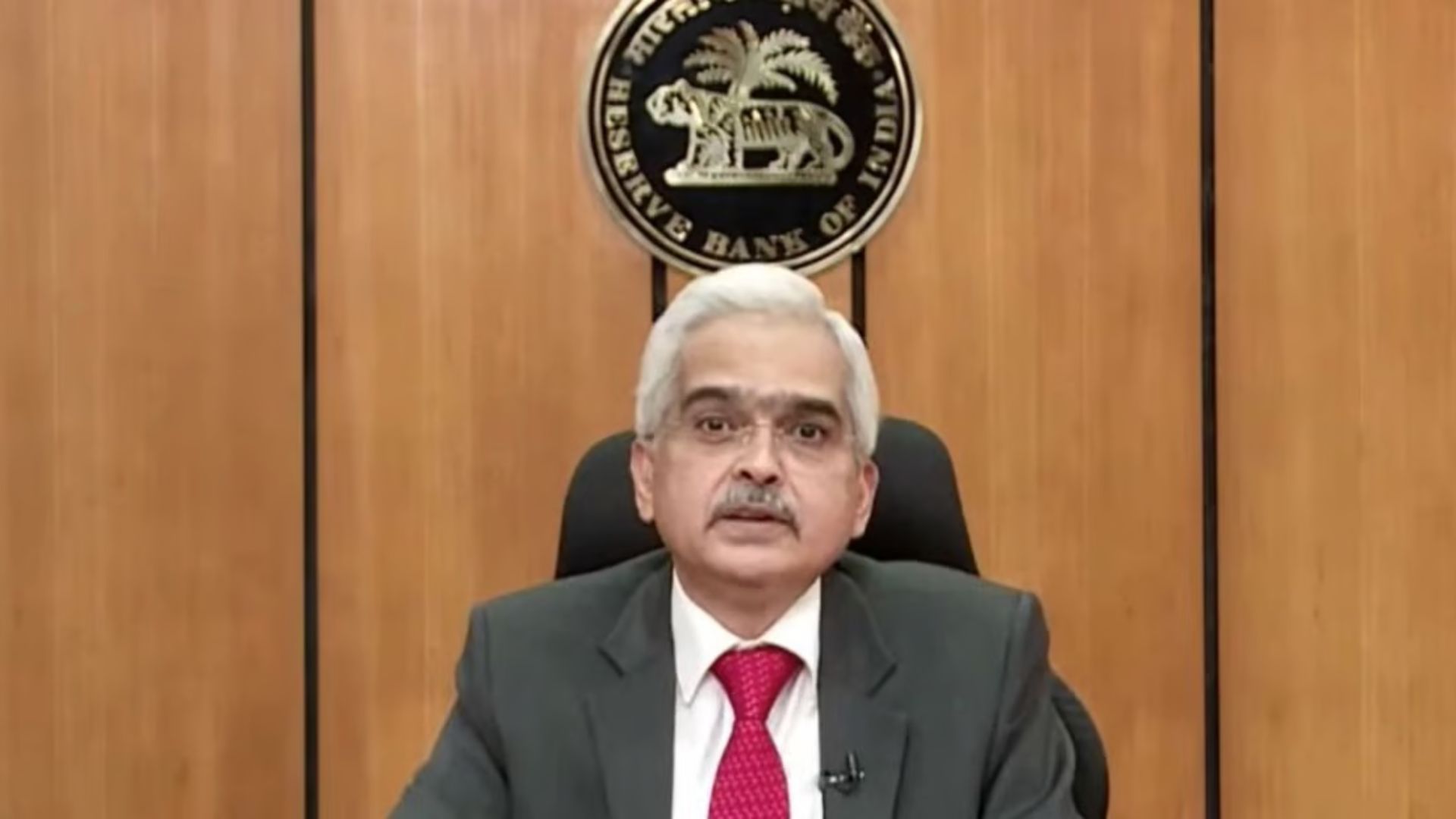

The Reserve Bank of India’s (RBI) Monetary Policy Committee unanimously decided to maintain the status quo at the policy repo rate of 6.5% during its February review meeting. The interest rate at which the RBI lends to other banks is known as the repo rate. Following a three-day review meeting, RBI Governor Shaktikanta Das deliberated on the policy statement on Friday morning. He cited stable growth dynamics and comfortable inflation as justifications for keeping the policy stance unchanged.

Das said inflation is moving closer to the target and growth is holding better than expected.

Retail inflation in India though, is in RBI’s 2-6 per cent comfort level but is above the ideal 4 per cent scenario. In December, it was 5.69 per cent

Das said the MPC also decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

The current financial year 2023–24 saw the fastest-growing major economy, the Indian economy, expand by 7.6% during the July–September quarter. For the quarter ending in June, India’s GDP expanded by 7.8%. It started on Tuesday, the first day of the RBI’s three-day bi-monthly monetary policy committee (MPC) meeting. Every financial year, the RBI holds six bimonthly meetings where it discusses a range of macroeconomic topics, including interest rates, the money supply, the outlook for inflation, and the outlook for inflation. It’s possible that the central bank lowered the key interest rate once more due to a significant drop in inflation and the possibility of additional declines.