The Indian Railway Catering and Tourism Corporation (IRCTC) has revealed its first-quarter results, which ended on June 30.

The Indian Railways’ ticketing, catering, and tourist division revealed that income jumped by 250 percent year on year to 852.6 crores due to higher-than-expected catering revenue.

According to the corporation, 11.58 crore tickets were bought online in the first quarter of the fiscal year, resulting in a convenience fee income of 210 crores.

According to IRCTC, the catering category delivered consistent performance and is intended to reach 1,500 crores by the end of the fiscal year. Earnings before interest, taxes, and depreciation (EBITDA) climbed 187.8 percent year on year to 320 crores, with a margin of roughly 38% compared to 45.8 percent in the same quarter the previous year.

According to the corporation, the tourist division achieved EBIT breakeven for the first time since the Covid-19 epidemic, with a margin of 1.1%.

The following are some of the significant features of the IRCTC’s quarterly results:

IRCTC’s current market price is $670 per share, with a target price of $635 per share. Jinesh Joshi, a research analyst at Prabhudas Lilladher Pvt Limited, a financial services firm, recommends owning the shares for the time being.

“IRCTC trades at 58x/53x our FY23E/FY24E EPS forecasts, and we believe current values reflect good growth potential (25% EPS CAGR over FY22-FY24E), allowing space for earnings surprise.” Furthermore, the profits CAGR over the next five years after FY23 (which includes the advantages of catering and rail network development) is 6% owing to the lack of major growth drivers, making values expensive,” Joshi stated.

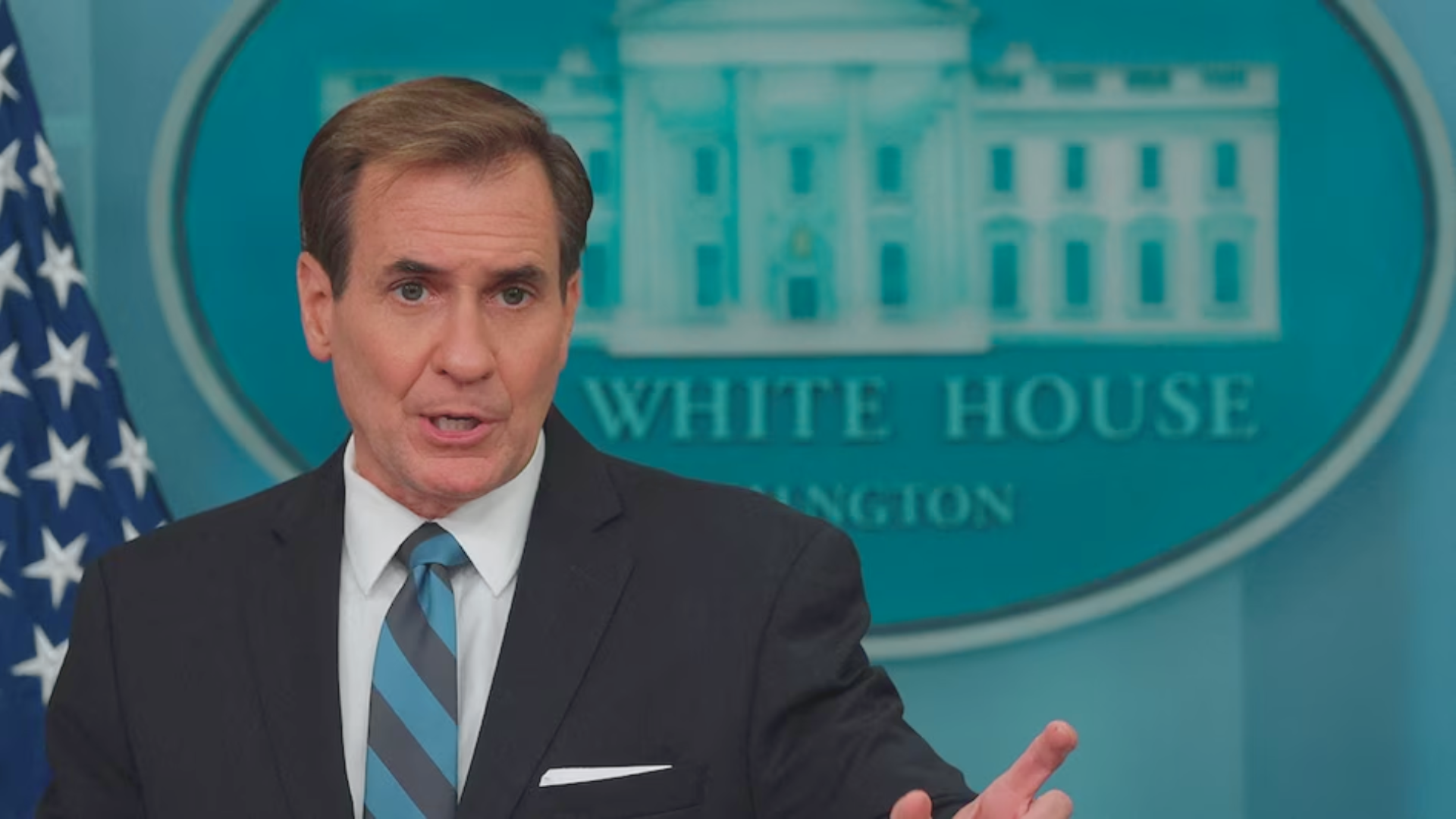

Also Read: Bengaluru: Top US ambassador meets business executives and entrepreneurs