As technological advancements continue to evolve, so do the tactics of fraudsters looking to exploit vulnerabilities in banking systems. Recently, a concerning trend has emerged in Delhi, where a gang of scammers is targeting unsuspecting ATM users through a scheme known as the “ATM card trap” scam. With incidents on the rise, it’s essential for individuals to be vigilant and informed about these deceptive practices to safeguard their financial assets.

Understanding the ATM ‘Card Trap’ Scam

The modus operandi of the fraudsters begins with discreetly manipulating the card reader in unguarded ATMs across Delhi. To evade detection, they often resort to spray-painting the CCTVs to eliminate evidence. Once a victim completes a transaction, their card gets trapped in the machine. Seizing the opportunity, the scammers, posing as helpful citizens, coax the victim into re-entering or sharing their PIN to resolve the issue. Even after the victim complies, the card remains stuck, leaving them with no choice but to leave or seek assistance from the bank. However, unbeknownst to the victim, the fraudsters, having observed the PIN, retrieve the card later and engage in fraudulent transactions.

Escalation of Fraudulent Activities

In some instances, the perpetrators of these scams resort to violence to evade capture. A recent incident reported gunfire when individuals attempted to thwart the tampering of an ATM in Uttam Nagar. This underscores the audacity and recklessness of these criminal operations, posing a serious threat to public safety.

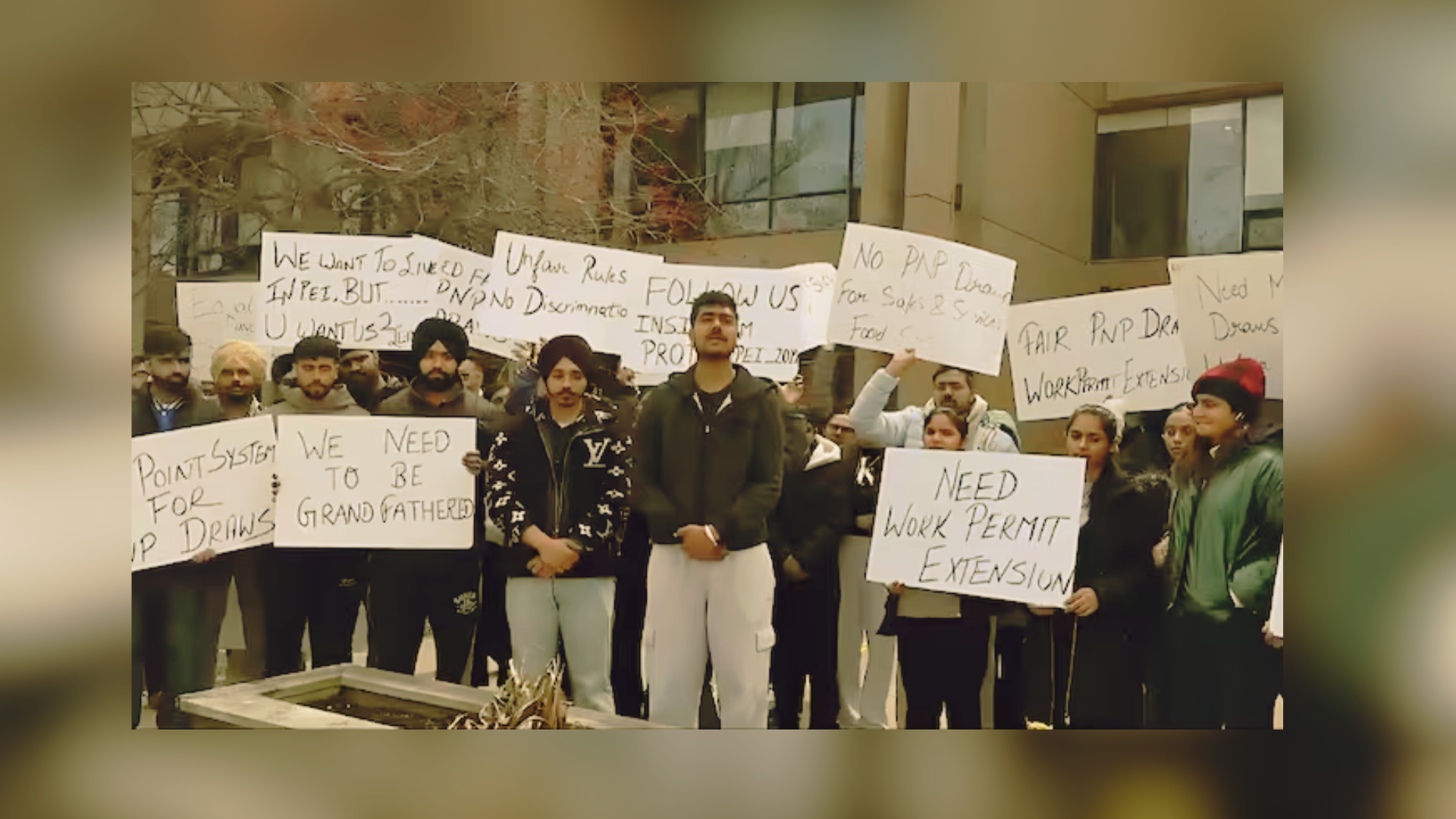

Law Enforcement Response

Despite the challenges, law enforcement agencies have made strides in apprehending perpetrators. Recently, Delhi Police arrested three members of a gang involved in multiple ATM tampering incidents across various districts. This underscores the importance of collaborative efforts between law enforcement and the public in combating such crimes.

Safeguarding Yourself: Tips to Stay Protected

1. Choose Well-Lit ATMs Opt for ATMs located in well-lit areas with security guards, as they are less susceptible to tampering.

2. Be Vigilant for Signs of Tampering: Inspect the ATM for any loose or unusual components around the card slot, and be wary of suspicious devices attached to the machine.

3. Exercise Caution: Avoid seeking help from strangers and handle transactions independently. If encountering issues, contact authorized bank personnel for assistance.

4. Protect Your PIN: Always shield the keypad while entering your PIN to prevent unauthorized access. Failure to do so could result in ATM card skimming and subsequent fraud.

5. Monitor Account Activity: Regularly review your bank statements for any unauthorized transactions and remain wary of enticing offers that may lead to financial exploitation.

6. Stay Informed: Educate yourself about common ATM fraud tactics such as shimming and card cloning, and remain vigilant while conducting transactions.

As ATM fraud cases continue to rise, it is imperative for individuals to remain vigilant and proactive in safeguarding their financial assets. By adhering to best practices and staying informed about emerging scams, we can collectively combat fraud and protect our financial well-being. Remember, awareness is the first line of defense against deception in the digital age.