The Delhi High Court requested a statement from the Reserve Bank of India (RBI) on Monday in response to a Public Interest Litigation (PIL) seeking direction to create a Uniform Banking Code for foreign currency transactions in order to limit black money production and Benami transactions.

While issuing a notice to the RBI, the Bench of Justice Satish Chander Sharma and Justice Subramonium Prasad stated that the matters require a thorough hearing. According to petitioner Ashwini Kumar Upadhyay, it not only harms the national interests of India’s foreign exchange reserve, but it is also used to provide money to separatists, fundamentalists, Naxals, Maoists, terrorists, traitors, conversion mafias, and radical organisations.

The Predecessor Bench had previously issued a notice to the Union of India, requesting that the respondents investigate the matter thoroughly.

Earlier, Additional Solicitor General (ASG) Chetan Sharma appeared on behalf of the Central Government and stated that the issues raised by the petitioner require careful consideration.

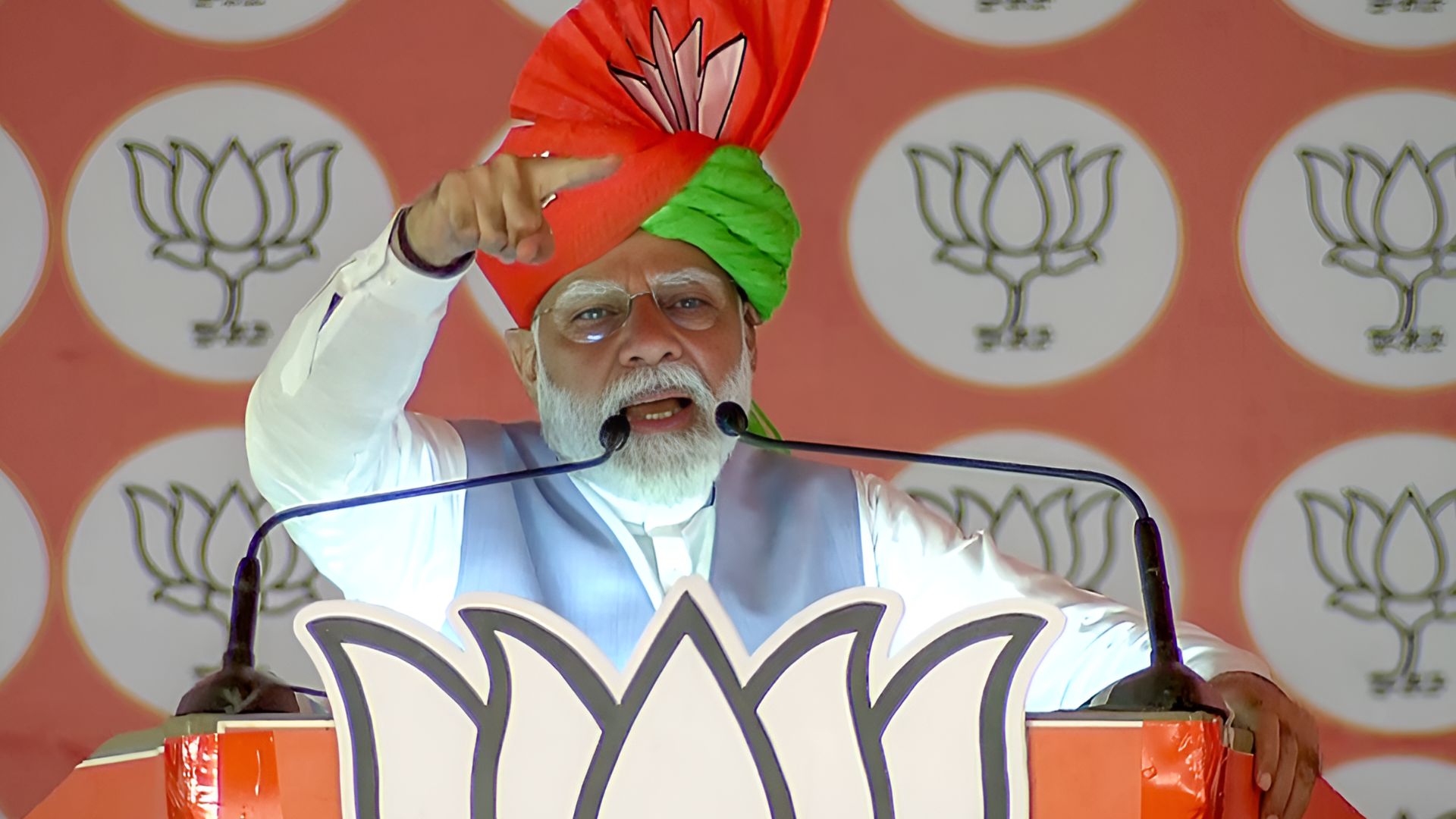

Petitioner Ashwini Kumar Upadhyay, practising lawyer and BJP leader, also sought direction to ensure that Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT) and Instant Money Payment System (IMPS) are not used for depositing foreign money in Indian banks.

The petitioner submitted that the immigration rules for a visa are the same whether a foreigner comes in business class or economy class, uses Air India or British Airways, and comes from USA or Uganda.

Likewise, Upadhyay said that the deposit details in Indian banks, including foreign bank branches for foreign exchange transactions, must be in the same format whether it is export payment in a current account or salary in a savings account or donation in charities current account or service charges payable in YouTuber’s accounts. The format should be uniform whether it is converted by Western Union or National Bank or an India-based foreign bank.

“Foreign Inward Remittance Certificate (FIRC) must be issued and All International and Indian banks must send the link through SMS to get FIRC automatically in case Foreign Exchange is being deposited in the account as converted INR,” the plea stated.

“Moreover, only a person or company should be permitted to send Indian Rupees from one bank account to another inside the territory of India through the RTGS, NEFT and IMPS and international banks should not be allowed to use these domestic banking transactions tools,” it added.

The petitioner also sought direction that foreign exchange transactions through Indian banks including foreign bank branches in India viz. ICICI, HDFC, HSBC, etc must-have information like the name and mobile number of the depositor, International Money Transfer (IMT) and not RTGS/NEFT/IMPS, name of currency e.g., AUD (Australian Dollars), USD (US Dollars), CNH (Chinese Yuan), GBP (Great British Pounds), EUR (Euro), etc.