The central government’s endeavours to develop the Indian semiconductor industry will help reduce the country’s reliance on imported chips by an estimated USD 10 billion to USD 20 billion, said a report by a major consultancy firm, McKinsey.

According to the firm, India must combine targeted government incentives with strategic collaborations involving global technology giants to accelerate the growth of its semiconductor industry. The consultancy highlights that such a dual approach is essential for India to establish itself as a key player in the global semiconductor value chain.

“To realise this potential value and reduce import dependency, India will require a mix of targeted government incentives and partnerships with global technology leaders,” the report added.

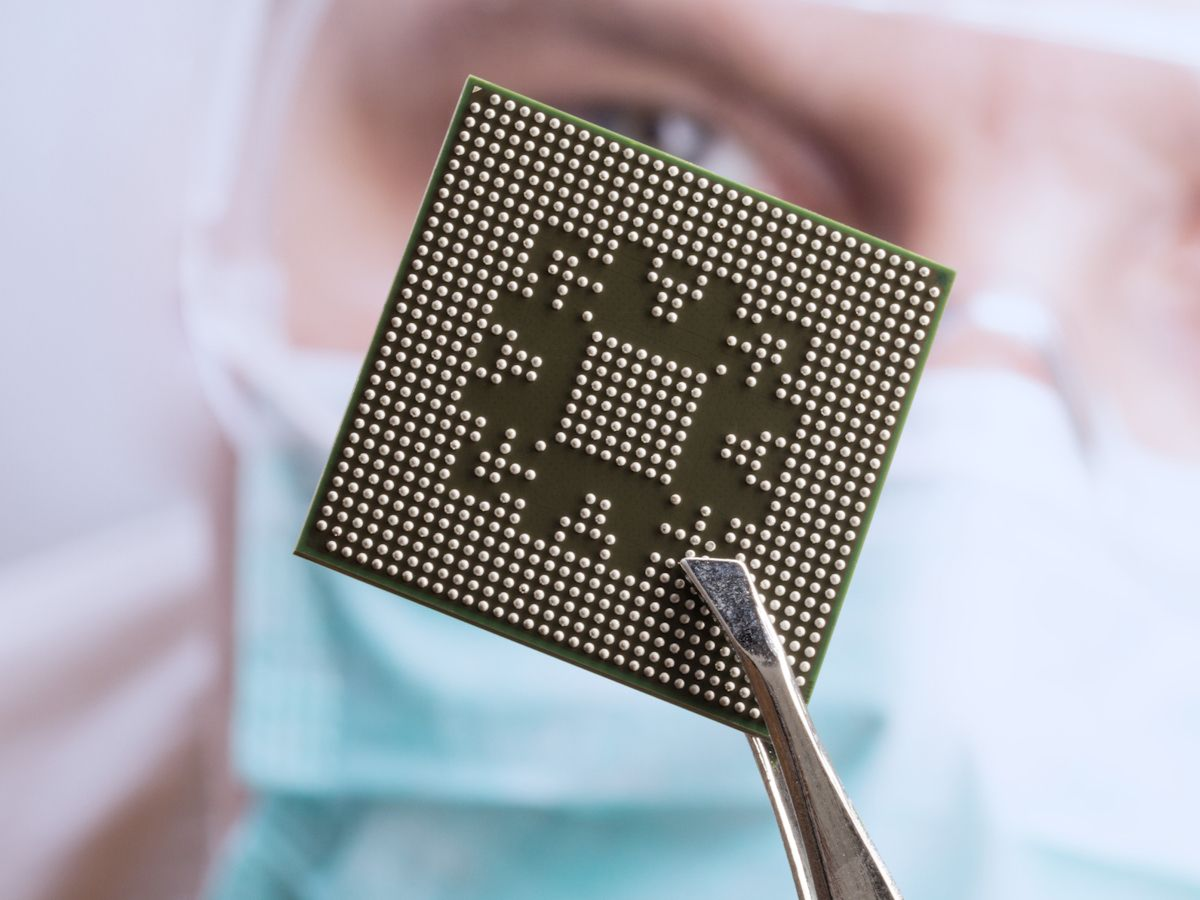

Semiconductor chips are essential components in virtually all electronic devices, enabling a wide range of functionalities from basic computation to advanced technologies. According to the estimates, Indian market for semiconductors is expected to cross USD 100.2 billion by 2032 from USD 34.3 billion in 2023.

Today, India’s semiconductor industry is primarily centered on design. The country accounts for about 20 per cent of the global semiconductor design workforce and is home to Research and Development (R&D) hubs for major players. Over the past year, several large projects, ranging from USD 3 billion to USD 11 billion, have been announced, signalling a strategic move toward outsourced semiconductor assembly and testing (OSAT) and legacy-node fabrication.

The report stated that these efforts are backed by roughly USD 10 billion in government incentives, which are expected to help reduce the country’s reliance on imported chips. India’s strength in chip design is supported by a large talent pool and a growing start-up ecosystem, putting the country among the top three global design hubs. However, the transition to large-scale semiconductor fabrication is expected to be a gradual process, stated the firm.

India’s semiconductor industry is pushing to achieve fabrication at nodes above 14 nanometers by 2030; moving to sub-ten-nanometer technologies will likely take longer. The main challenges are high capital requirements, limited access to advanced manufacturing technologies, and gaps in the domestic supply chain, especially for high-purity gases, specialty chemicals, and ultrapure water.

“Partnerships with prominent global semiconductor companies could catalyze and accelerate the advancement of this industry,” the firm further added

Also Read:

Aishwarya is a journalism graduate with over three years of experience thriving in the buzzing corporate media world. She’s got a knack for decoding business news, tracking the twists and turns of the stock market, covering the masala of the entertainment world, and sometimes her stories come with just the right sprinkle of political commentary. She has worked with several organizations, interned at ZEE and gained professional skills at TV9 and News24, And now is learning and writing at NewsX, she’s no stranger to the newsroom hustle. Her storytelling style is fast-paced, creative, and perfectly tailored to connect with both the platform and its audience. Moto: Approaching every story from the reader’s point of view, backing up her insights with solid facts.

Always bold with her opinions, she also never misses the chance to weave in expert voices, keeping things balanced and insightful. In short, Aishwarya brings a fresh, sharp, and fact-driven voice to every story she touches.