The exchange rate between the two currencies of Bangladesh and Pakistan is one of the most obvious measures that would be measured when comparing the two currencies.

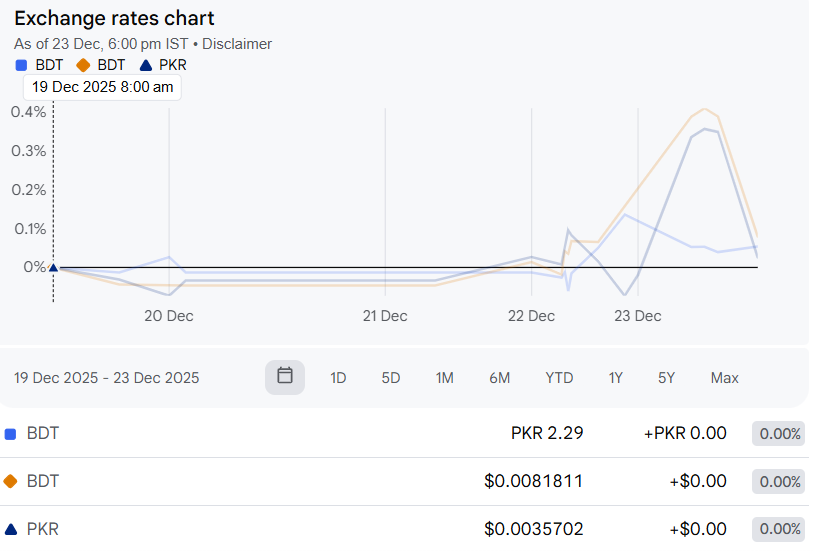

By the end of 2025, 1 Bangladeshi Taka (BDT) will be worth around 2.29-2.30 Pakistani Rupees (PKR) in the foreign exchange market.

This implies that one unit of Bangladesh currency will purchase over twice the amount of Pakistan currency, implying that the Taka is of higher value per unit as compared to the Rupee in the direct bilateral relationship.

Bangladesh vs Pakistan Currency War

Practically, a conversion of cash on the current interbank rates as of now would mean that 1 BDT would be approximately 2.29 PKR and vice versa, 1 PKR would be approximately 0.436 BDT.

This direct comparison does not imply that the Bangladeshi economy is in any way inherently better than the Rupee in every way, but it does indicate that at the given moment Taka has better purchasing power compared to the Rupee when traded directly.

The power of a currency, such as the Taka or the Rupee, is affected by more economic fundamentals. The economy of Bangladesh has experienced a continued export development, high levels of remittance inflows and a relatively fixed foreign exchange reserves over the past few years that help to stabilise the Taka.

The garment industry in Bangladesh, especially, has contributed to a significant share of import incomes, which have been constant providers of foreign exchange to support the external value of the Taka.

In comparison, the Pakistani Rupee has experienced ongoing downward forces associated with the macroeconomic problems that included chronic trade deficits, excessive external debt servicing expenses and regular balance-of-payments strain.

These variables have resulted in bouts of depreciation against major currencies such as the U.S. dollar and have added to the current volatility and weak state of the Rupee value in comparison with its peers.

Another fact worth noting is that as the market conditions and policies of central banks and the sentiments of investors change, so does the exchange rate at a given time. As an illustration, the Taki rate versus the Rupee has been relatively stable in the past few months, indicating that there is low volatility in the bilateral rate.

In the meantime, the authorities of Pakistan have made a number of attempts to stabilise the situation at the Rupee by operating in the foreign exchange market, and this is an indication that there will be continued pressure on the currency.

To conclude, as at the given exchange rates, the Bangladeshi Taka is stronger than the Pakistani Rupee in the quantity of Rupee that it can purchase. 1 BDT is approximately 2.29–2.30 PKR, and 1 PKR is approximately 0.436 BDT.

Nevertheless, the strength of the currency is only one prism through which one can see economic performance; more extensive metrics such as GDP growth, inflation, and foreign reserves are additional tools that can tell a person more about the overall health of each economy.

Current economic status of Pakistan and Bangladesh as compared to India?

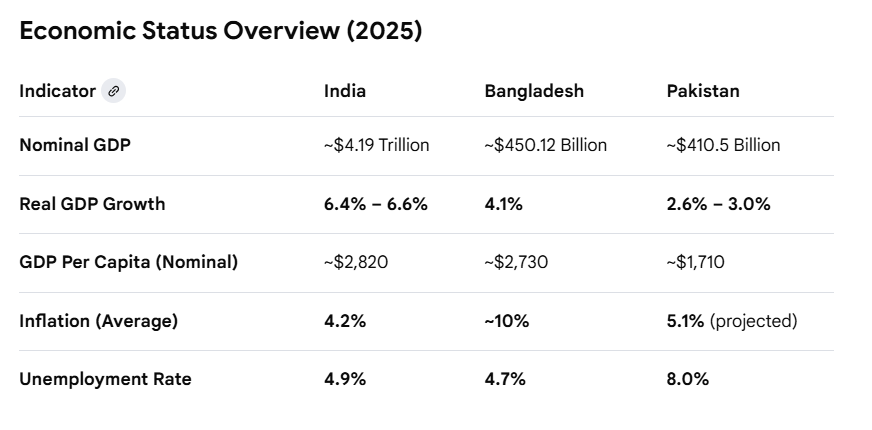

In 2025, the economic prospects of South Asia are characterised by India becoming a global force, Bangladesh being resilient, and Pakistan still living on a slow recovery route. India is still the powerhouse and its nominal GDP is about 10.5 times that of Pakistan.

1. India: The Regional Anchor

India is the 4 th largest economy in the world in 2025 as it has overtaken Japan. It continues to have the quickest growth rate amongst major economies in the world, with increasing domestic consumption coupled with high investment by foreigners.

External Strength: India has good foreign exchange reserves amounting to about 686 billion, which gives it enormous stability in comparison with its neighbours.

Fiscal Management: India has managed to contain its inflation at about 4.2 by the tight monetary policy, which is much low than the two-digit figures experienced over the years in the region.

2. Bangladesh: The Leader of Resilience

The country is still leading in terms of per capita where it is neck-and-neck with India.

Growth Prospects: Despite the declining growth of 4.1% during the 2024/25 financial year owing to increased political uncertainty and low industry activity levels, it is expected to resume 5.4% the next year.

Geopolitical Strength: Dhaka has gathered geopolitical power progressively with a nominal GDP that surpasses Pakistani, and is now ranked as the second largest economy in South Asia.

3. Pakistan: Finding a Way through Recovery

The Pakistani economy is experiencing an unstable recovery following several years of gross volatility, whereas it is still far behind its neighbours on most human development and stability indices.

Modest Rebound: The fiscal year ending June 2025 growth would see an estimation at 3.0% which compares to the previous year where growth was 2.6% due to a revived industrial and service sector.

Structural Problems: The country still has a high rate of unemployment of 8 per cent and it is still extensively reliant on foreign aid including IMF bailouts and help of the friendly countries to dispose its wavering reserves that hardly exceed $15 billion.