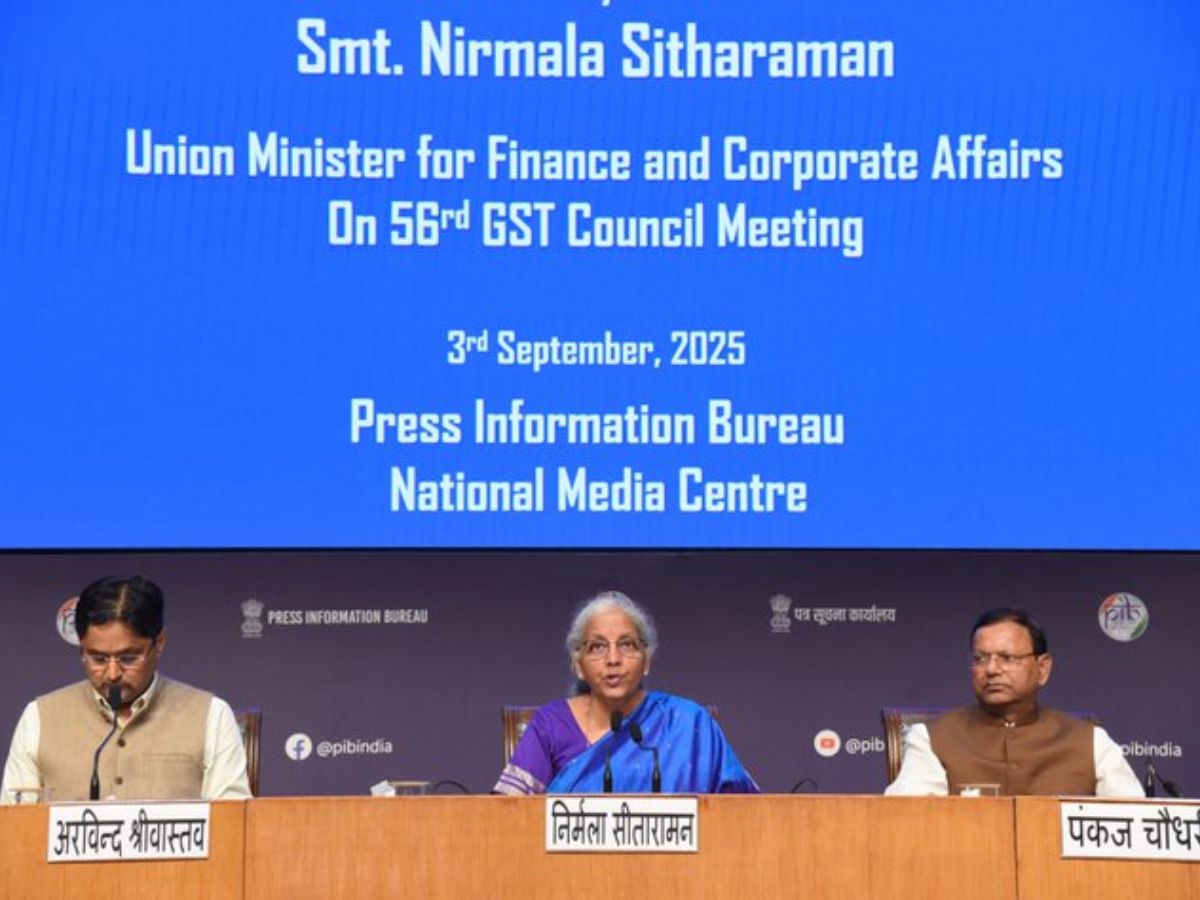

Union Finance Minister Nirmala Sitharaman chaired the 56th meeting of the Goods and Services Tax Council on Wednesday, September 3, 2025. A simplified GST structure with rate reductions across key sectors of trade and commerce was introduced. Essential industries, including leather, footwear, paper, textiles, and handicrafts, have been covered under this reform.

As part of the new-generation reform, the GST shifted to a two-slab system of 5% and 18%, removing the earlier 12% and 28% rates. Apart from these slabs, 40% slab is for the super luxury items.

In a post on X, Prime Minister Narendra Modi hailed the reform, stating that it will benefit the common man, farmers, MSMEs, middle-class, women and youth.

The last decade has been about bold reforms aimed at transforming India’s economic landscape, from corporate tax cuts that spurred investment, to GST creating a unified market, to personal income tax reforms enhancing Ease Of Living.

The #NextGenGST Reforms continue this… https://t.co/OHxFzUvi5t

— Narendra Modi (@narendramodi) September 4, 2025

As per the constitutional provisions, only the GST Council would recommend on issues related to GST, which items should be included or which ones exempted in tax slabs and what should be the GST rates for goods. Here’s a look at the GST Council, how it is constituted and how it deals with the tax rates.

What is The Goods And Services Tax Council?

The 101st Constitution Amendment Act, 2016, allows the Constitution to constitute the Centre of Goods and Services Tax Council. It states that, as per Article 279A (1), the Council should be constituted by the President within 60 days of the commencement of the Amendment Act, 2016.

Article 279A (2) of the Constitution gives details of the GST Council members. It states that the Council would include the Union Finance Minister as the Chairperson, the Union Minister of State in charge of Revenue or Finance as members, the Minister in charge of Finance or Taxation or any other Minister nominated by States Government as members and any person nominated by the Governor of the State where there is a proclamation of emergency under Article 356 of the Constitution of India.

Formation Of The GST Council

On September 12, 2016, the Union Cabinet approved the setting up of the GST Council with its office in New Delhi. The criteria follow as the Secretary (Revenue) will work as the Ex officio Secretary to the GST Council. It also includes the inclusion of the Chairperson, Central Board of Excise and Customs (now Central Board of Indirect Taxes and Customs), as a permanent invitee (non-voting) to all proceedings of the GST Council and the creation of one post of Additional Secretary to the GST Council in the GST Council Secretariat and four posts of Commissioner.

Function Of The Goods And Services Tax Council

As per Article 279A(4), the GST Council will be responsible for making recommendations on issues related to GST, such as the goods and services that may be subjected to or exempted from GST and model GST Laws.

The GST Council will take decisions by a majority of not less than three-fourths of weighted votes cast. As per provisions, the Centre has one-third weightage of the total votes cast, and all the states taken together have two-thirds of the weightage of the total votes cast. It is added that all decisions taken by the GST Council have been arrived at through consensus.

When Was The First Meeting And The Latest Meeting Of The Council?

On Sept 22nd and 23rd, 2016, the first meeting of the GST Council was held. Since then, the Council meets periodically to decide on various issues related to GST.

The latest meeting (56th) was held on Sept 3, 2025, in which the tax slabs were reduced to two: 5% and 18%, from four. Earlier 12% and 28% rates of tax have been eliminated.

ALSO READ: Semicon India 2025: A Trail Of India’s Semiconductor Journey