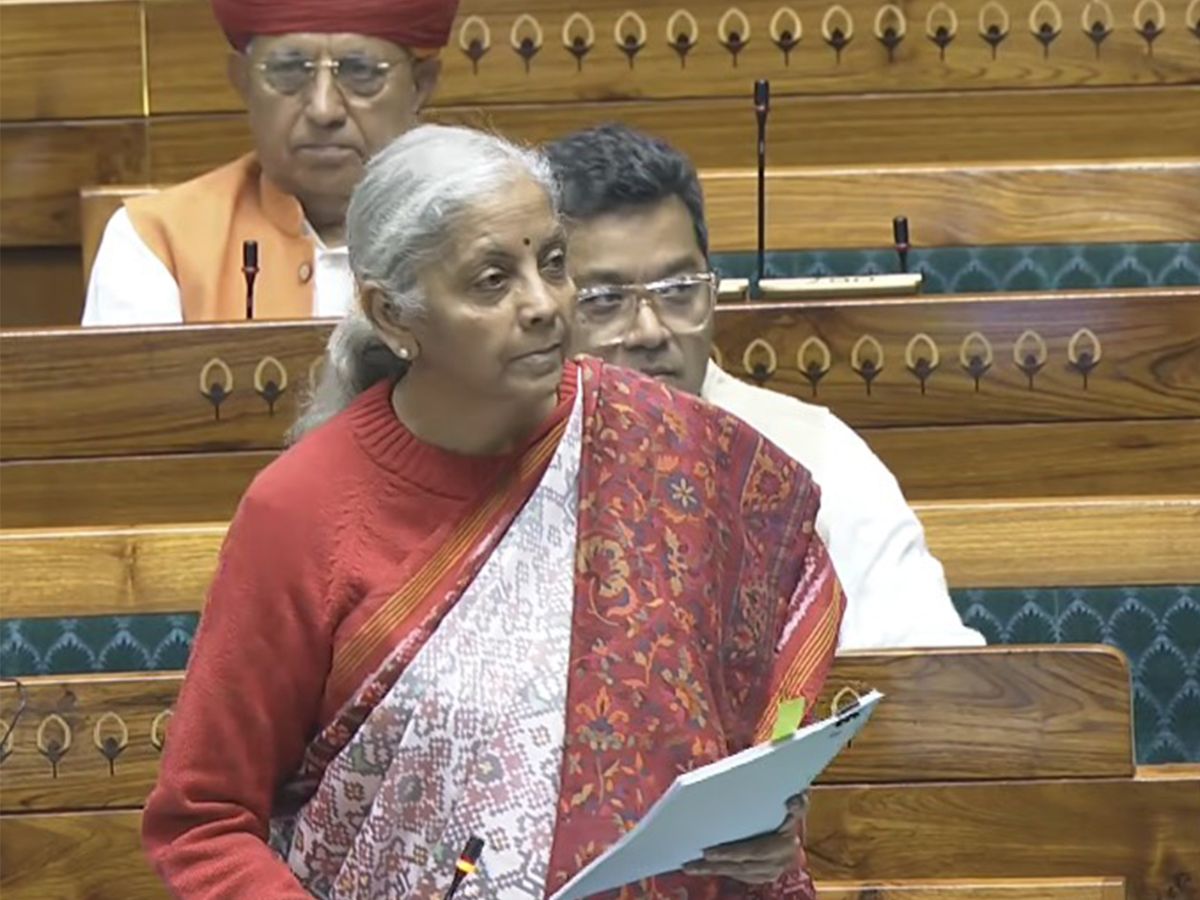

Finance Minister Nirmala Sitharaman on Sunday presented her ninth Union Budget, outlining proposals aimed at boosting economic growth, promoting inclusive development, and meeting citizens’ aspirations.

While several sectors are set to gain from the budget, some industries face challenges due to new policies. Here’s a detailed look at who benefits and who faces pressure.

Big Budget Moves: Key Announcements

-

₹40,000 crore allocated to promote electronic components manufacturing.

-

₹10,000 crore earmarked for biopharmaceuticals to position India as a global hub.

-

Portfolio Investment Scheme for people of Indian origin (PIOs) raised from 5% to 10% per individual, overall cap increased from 10% to 24%.

-

Five new medical tourism hubs announced, boosting hospital stocks.

-

Funding for seven high-speed rail routes, dedicated freight corridors, and container manufacturing ecosystem.

-

Creation of Infrastructure Risk Guarantee Fund to support private infrastructure developers.

-

Plans to unlock the economic potential of cities via City Economic Regions (CERs) with Rs 5,000 crore per CER over five years.

Budget Winners: Sectors Poised to Benefit

Pharmaceuticals / Biopharma

The government announced $1.1 billion over the next five years to boost biologics and biosimilar drug production. Major players like Sun Pharma and Biocon saw a surge in their stock prices following the announcement. India aims to become a global biopharma manufacturing hub, especially with rising non-communicable diseases like diabetes and cancer.

Textiles

Policy measures, including mega textile parks, are expected to benefit apparel makers impacted by US tariffs. Companies such as Raymond Ltd. and Trident Ltd. saw significant gains in trading after the announcement.

Electronic Manufacturing

A $4.3 billion allocation for electronic components is set to strengthen India’s electronics supply chain, particularly as companies like Apple expand manufacturing in India. Stocks of local players like Dixon Technologies, Amber Enterprises, and Kaynes Technology rose following the budget.

Data Centers and Cloud Infrastructure

A tax holiday until 2047 for foreign companies providing cloud services globally from India-based data centers boosts the data infrastructure sector. Companies like Anant Raj Ltd. witnessed notable gains as AI and cloud investments surge.

Hospitals and Medical Tourism

The announcement of five new medical tourism hubs lifted hospital stocks, including Apollo Hospitals, Fortis, and Metropolis Healthcare.

Infrastructure and Shipping

Allocations for freight corridors, high-speed city rail routes, and container manufacturing are set to benefit shipping and logistics players. Companies such as Shipping Corp of India, Essar Shipping, and Container Corp of India experienced strong market reactions.

Budget Losers: Sectors Under Pressure

Brokers and Stock Exchanges

The government hiked Securities Transaction Tax (STT) on futures and options, aiming to curb speculative retail trading. Stocks of brokers like Angel One Ltd. and exchanges like BSE fell sharply after the announcement.

State-Owned Banks (PSU Banks)

Investors anticipated bank consolidation and FDI relaxation, which did not materialize. Plans to sell a record amount of government bonds could affect treasury incomes. Shares of State Bank of India and other PSU banks declined, with the Nifty PSU Bank Index dropping by as much as 7%.

Clean Energy

The sector had hoped for tax rationalization and lower customs duties on critical components to accelerate net-zero initiatives. Lack of significant support disappointed investors and industry stakeholders.

Market Reaction

While manufacturing, data centers, and hospital stocks surged, Nifty 50 fell up to 3% after the budget due to the derivative tax hike. Investors are carefully weighing the impact of both growth-oriented allocations and regulatory measures.

Union Budget 2026 reflects a push towards manufacturing, infrastructure, and health sectors, while policies on derivatives and bond issuance put brokers and PSU banks under pressure. Market watchers are eyeing how these measures play out in the coming months.

Sofia Babu Chacko is a journalist with over five years of experience covering Indian politics, crime, human rights, gender issues, and stories about marginalized communities. She believes that every voice matters, and journalism has a vital role to play in amplifying those voices. Sofia is committed to creating impact and shedding light on stories that truly matter. Beyond her work in the newsroom, she is also a music enthusiast who enjoys singing.