Donald Trump has introduced a new set of tariff rates on countries worldwide, raising duties on their exports to the US, starting August 7 instead of earlier deadline – August 1.

This new tariff anouncement is expected to create fresh tensions in the global trade ecosystem, especially as several nations have yet to finalize trade agreements with the Trump administration.

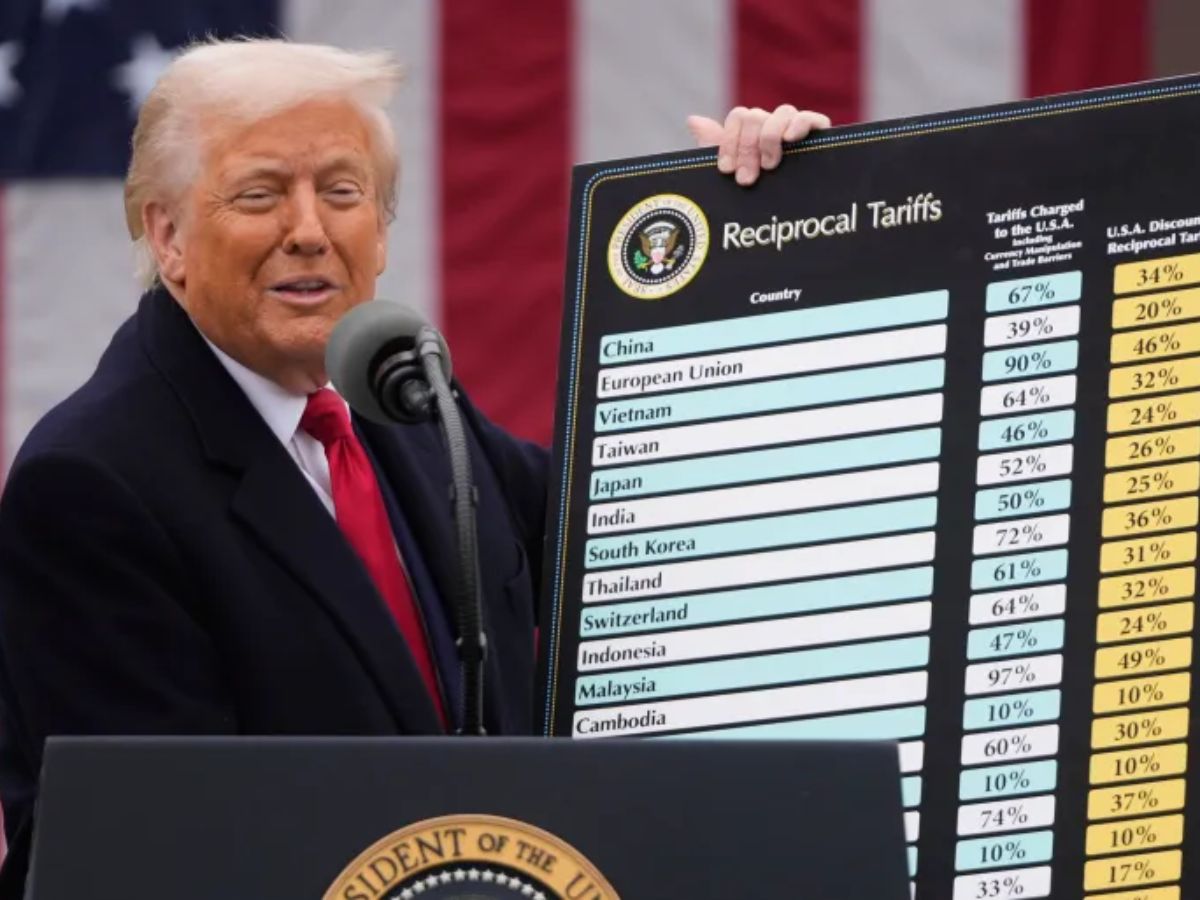

The White House on Thursday released a list of countries that will face new tariffs ranging from 10% to as high as 41%. Even countries not included on the list will now be subject to the standard 10% tariff on exports to the US.

Reasoning Behind The Trump Tariffs

Key trading partners such as the EU, UK and Japan have either signed trade deals with the United States or are in the final stages of negotiation. Despite this, these nations will still face higher tariffs than they did during Trump’s previous term. China and Mexico have received extensions to the deadline, but they too are expected to encounter elevated tariffs eventually.

Also Read: Trump Tariffs: Here Are The Top 10 Countries With Highest New US Duties

Trump has defended the move by stating that these tariffs will help restore domestic manufacturing and push other countries to ease trade barriers on American goods. “There’s 200 countries,” Trump said earlier this month. “You can’t talk to all of them.”

While Trump has highlighted a significant rise in customs revenue as a success of his tariff strategy, economists have warned that the move could stoke inflation. Apple CEO Tim Cook has said that US tariffs are projected to cost the tech giant $1.1 billion this quarter alone.

Trump Tariffs on US Economy

Impact of The actual impact of these tariffs is being felt both in the US and globally. According to a report by the BBC, data and expert analysis indicate several major economic shifts.

The Budget Lab at Yale University estimated that as of July 28, 2025, the average effective tariff rate imposed by the United States on imported goods had surged to 18.2%, the highest level since 1934. This marks a steep increase from the 2.4% rate in 2024, before Trump returned to office for a second term. The lab further projected that, after consumption shifts, the average tariff rate will be 17.3%, still the highest since 1935.

US Sees Rise In Government Revnues After Trump Tariffs

The sharp rise in tariff rates has also resulted in a significant boost in government revenues. In June 2025, US tariff revenues stood at $28 billion, a figure that is three times the monthly average from 2024. Customs and excise tax collections by the Department of Homeland Security in June exceeded $25 billion, reflecting the impact of Trump’s policies.

In a June estimate, the Congressional Budget Office (CBO) stated that the increased tariff revenue would lower US government borrowing by $2.5 trillion over the next decade. This figure was based on tariffs imposed between January 6 and May 13, 2025, and takes into account anticipated adjustments in import and export flows.

However, the CBO also noted that the U.S. economy would likely shrink relative to its potential without the tariffs, partly because of retaliatory tariffs imposed by other countries in response to Trump’s measures. The federal deficit is expected to decrease by $2.8 trillion through 2035 due to the revenue generated from the tariffs.

Trump Tariffs And US Trade Deficit

One of Trump’s primary goals with the tariff policy was to reduce the US trade deficit, the gap between the value of imports and exports. But according to the BBC, the actual outcome has been quite the opposite. The US trade deficit hit a record high of $162 billion in March 2025, before dropping to $86 billion in June. The surge in imports was largely attributed to American companies stockpiling goods ahead of the tariff hikes to avoid additional costs.

Rise in Inflation After Trump Tariffs

Inflation has also begun to rise. The CBO projects an annual increase of 0.4 percentage points in inflation for both 2025 and 2026. In June, the official U.S. inflation rate stood at 2.7%, up from 2.4% in May, though still lower than the 3% rate recorded in January.

Consumer prices in the US have started to reflect the pressure of the new tariffs. Economists told the BBC that items such as major appliances, computers, sports equipment, books, and toys experienced price increases in June. Earlier research by the Budget Lab had predicted that the 2025 tariffs would disproportionately affect sectors like clothing and textiles. Short-term estimates projected that consumers would face a 39% increase in shoe prices and a 37% increase in apparel prices.

Domestic Investment After Trump Tariffs

Although Trump has insisted that tariffs would stimulate domestic investment, the CBO data paints a more nuanced picture. While higher tariffs are expected to reduce productivity and investment, these effects could be partially balanced by the reduction in government borrowing, which in turn increases the resources available for private investment. Still, the net result is that real, inflation-adjusted economic output in the United States is expected to decline.

Zubair Amin is a Senior Journalist at NewsX with over seven years of experience in reporting and editorial work. He has written for leading national and international publications, including Foreign Policy Magazine, Al Jazeera, The Economic Times, The Indian Express, The Wire, Article 14, Mongabay, News9, among others. His primary focus is on international affairs, with a strong interest in US politics and policy. He also writes on West Asia, Indian polity, and constitutional issues. Zubair tweets at zubaiyr.amin