Trump Slashes Credit Card Rates , 10% Only!

On January 10 at 1:00 am (IST), the normally controversial President Donald Trump made a sweeping gesture: as of January 20, every American might have credit card interest limited to 10%, at least that was the case during the inauguration of his self-proclaimed second term. After years of exorbitant rates, the President’s action has addressed one of the issues raised in the 2024 elections, leaving the public wondering: “Is it possible that my budget can finally breathe again?”

Though the exact nature of the change still has to be fully revealed, it is apparent to all that your cards might be charged a little more than the new rate.

President Donald Trump Frames Move as Protecting Americans

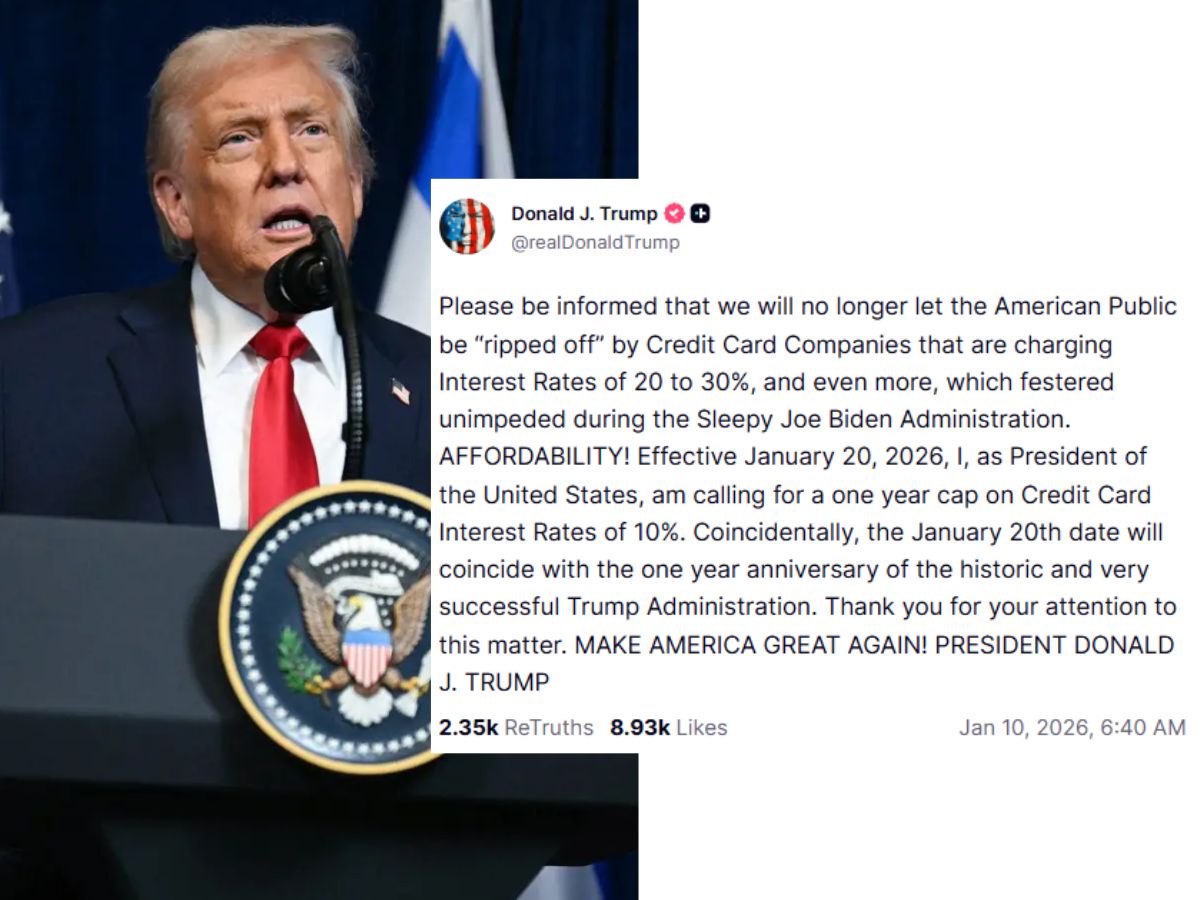

Trump stated on his social media platform, Truth Social:

“Effective January 20, 2026, I am calling for a one-year cap on Credit Card Interest Rates of 10%. We will no longer let the American Public be ‘ripped off’ by Credit Card Companies charging Interest Rates of 20 to 30%, and even more…”

He said the move aims to improve affordability for Americans and blamed his predecessor, “Sleepy Joe” Biden, for letting high credit card rates persist.

On the microblogging platform X (formerly Twitter), the official handle shared Trump’s Truth Social announcement and labeled it “HUGE.”. Top banks and credit card companies, like American Express, Bank of America, Capital One, Citigroup, and JPMorgan, have also not made any comments.

HUGE: President Donald J. Trump announces a one year cap on Credit Card Interest Rates of 10% effective January 20, 2026. 💸 pic.twitter.com/WKJ4Fk4SnC

— The White House (@WhiteHouse) January 10, 2026

Background And Trump Administration’s Actions On Credit Card Regulations

-

Bipartisan Legislative Efforts:

-

Senator Bernie Sanders and Senator Josh Hawley introduced legislation to cap credit card interest rates at 10% for five years.

-

Representatives Alexandria Ocasio-Cortez (D) and Anna Paulina Luna (R) proposed a similar House bill, reflecting cross-party concern over high rates.

-

-

Trump Administration’s Previous Moves:

-

Last year, the administration sought to scrap a federal credit card late fee rule from the Biden era.

-

They argued that the $8 cap on late fees was illegal, and a federal judge ultimately threw out the rule, siding with business and banking groups.

-

(With Inputs From Reuters)

Also Read: US Opens Door For India To Buy Venezuelan Oil Under Tight Washington Controls,

Aishwarya is a journalism graduate with over three years of experience thriving in the buzzing corporate media world. She’s got a knack for decoding business news, tracking the twists and turns of the stock market, covering the masala of the entertainment world, and sometimes her stories come with just the right sprinkle of political commentary. She has worked with several organizations, interned at ZEE and gained professional skills at TV9 and News24, And now is learning and writing at NewsX, she’s no stranger to the newsroom hustle. Her storytelling style is fast-paced, creative, and perfectly tailored to connect with both the platform and its audience. Moto: Approaching every story from the reader’s point of view, backing up her insights with solid facts.

Always bold with her opinions, she also never misses the chance to weave in expert voices, keeping things balanced and insightful. In short, Aishwarya brings a fresh, sharp, and fact-driven voice to every story she touches.