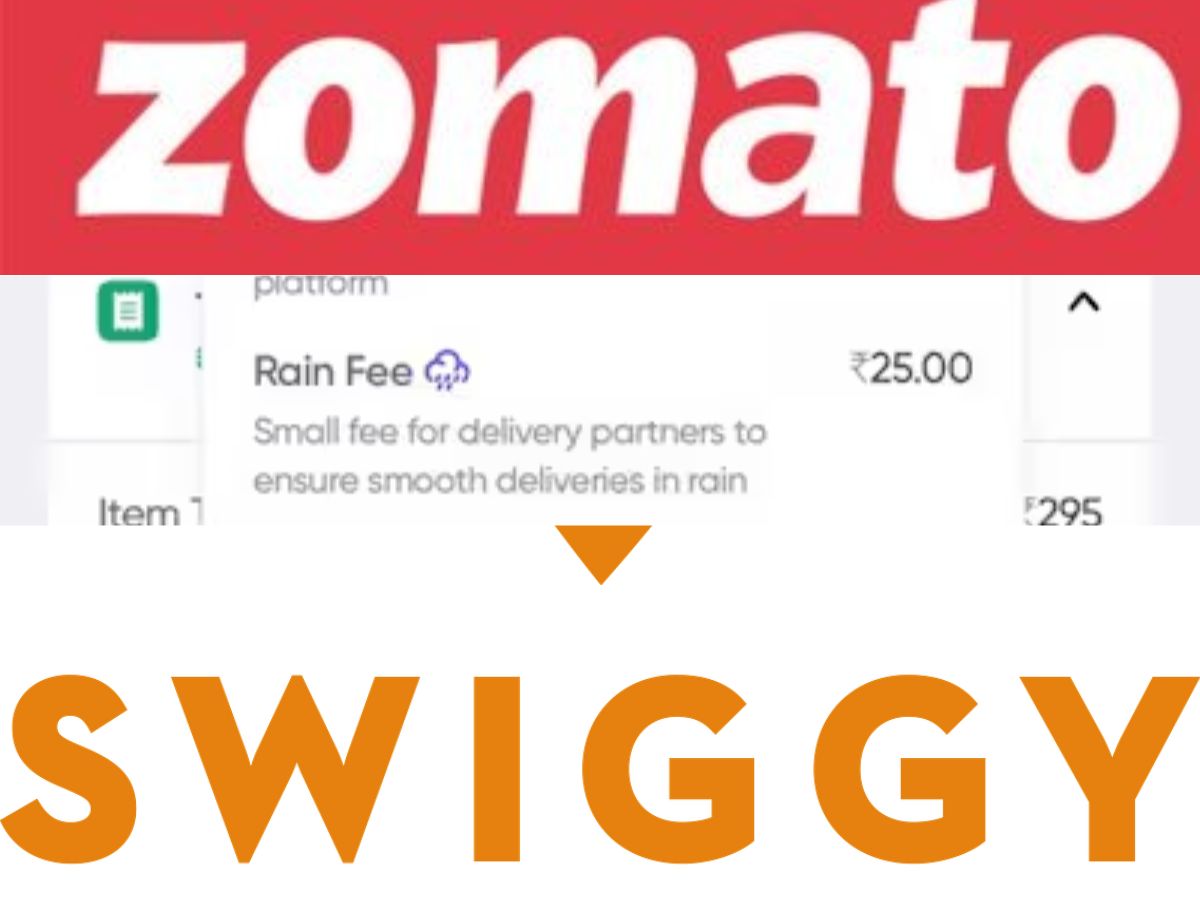

The recent social media outburst brings to the fore a new thing in food delivery, which is called a “rain fee”, further aggravated with an 18% GST just added as well! Customers on popular food delivery apps Zomato and Swiggy have gone to X to vent their displeasure. A viral post showing a bill from Swiggy that included a ₹25 rain fee with ₹5 GST added to that fee-initiated anger and, of course, hilarious memes about rain taxes.

The public hatred has arisen in response to the directive September 22, 2025 issued by the GST Council, which mandated an 18% GST to be levied on the delivery fee that the e-commerce operators, which include food delivery apps, charge. Given the arbitrary nature of these fees, many are now questioning the transparency of the fee structures of these platforms, especially given that they seem to be directly passing this tax onto the consumers.

Understanding the Financial Impact

GST application on delivery fees is another watershed moment in the food delivery industry. Earlier, GST was neither consistently applied nor levied on delivery fees viewed as pass-through payments to the delivery partners. Now, Section 9(5) of the CGST Act clarifies that the liability for such taxes rests with the platforms, Zomato and Swiggy. It is estimated that this variation would create additional tax liability to the tune of around ₹180-200 crores combined for the two companies.

After historic GST reforms, even Lord Indra has been brought under the tax net.

Now when it rains, you get ₹25 Rain Fee + 18% GST = ₹29.50 😂

Next up:

👉Sunlight Convenience Fee 🌞

👉Oxygen Maintenance Charge 💨

👉GST on Breathing, Pay as you inhale pic.twitter.com/JdtHfr715G— Ashish Gupta (@AshishGupta325) September 22, 2025

To service this new liability, it is likely that the companies would forthwith transfer part of the cost to the consumers, thus increasing the final price on the bill. Analysts have estimated that this could amount to an additional ₹2 to ₹2.6 for each order.

A Traditional Solution Enters the Chat

In this present digital-age dilemma, a simple old-fashioned solution has come back to life. This new fee structuring is argued by many social media users to make ordering directly from a local restaurant or a neighborhood Kirana store faster and, therefore, more appealing and economical. They often have their own delivery service, and these local businesses are not levied with the standard 18% GST on delivery fees.

For a consumer, this means that by ordering directly from the restaurant’s in-house delivery network or local store, they might have possibly saved some money. In a way, the controversy has somehow reminded consumers that sometimes all it takes is a phone call to bypass taxes and fees, which have now come to characterize the modern-day convenience of human beings.

Also Read: Shocking Viral Video: Man Carries Snake Inside The Train, Demands Money From Passengers

A recent media graduate, Bhumi Vashisht is currently making a significant contribution as a committed content writer. She brings new ideas to the media sector and is an expert at creating strategic content and captivating tales, having working in the field from past four months.