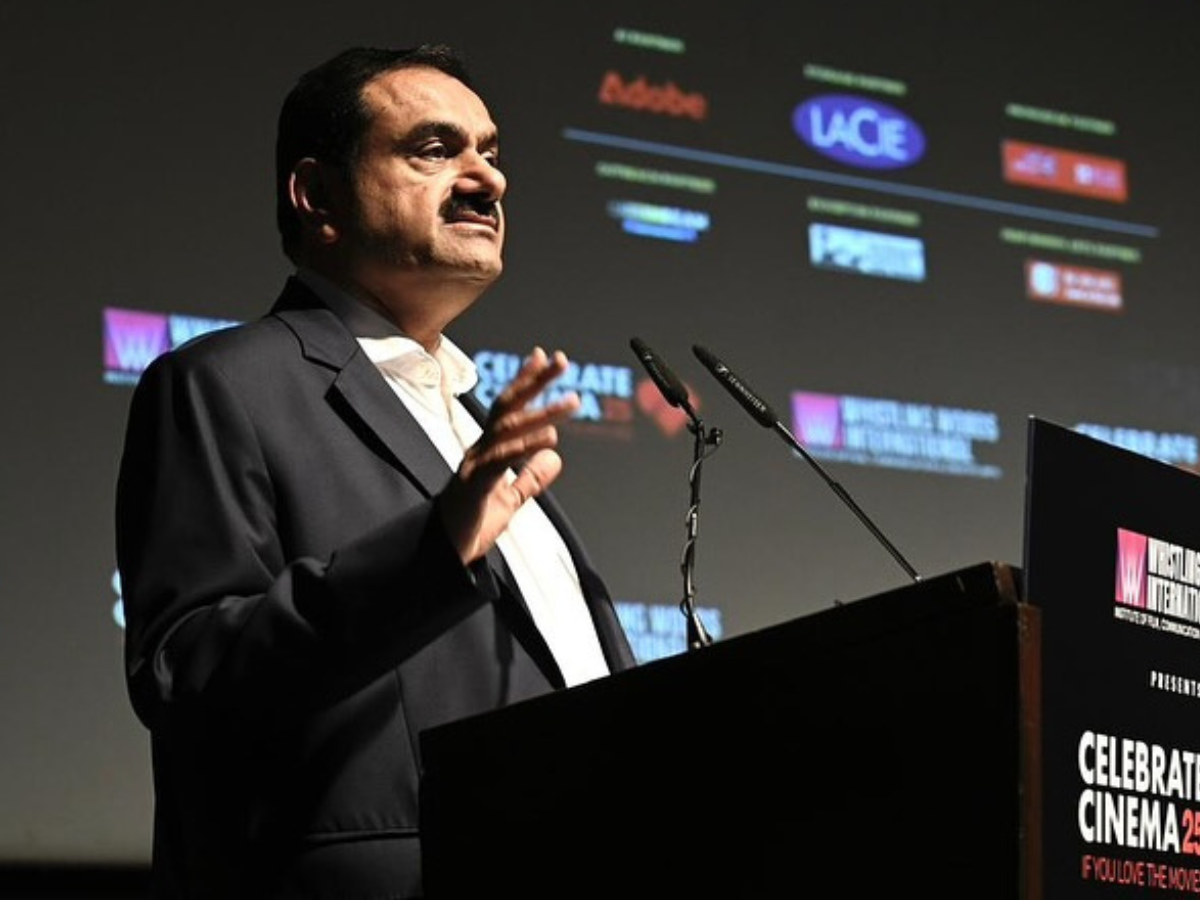

Adani Group Stocks Bounce Back – Investors Breathe a Sigh of Relief

Hold onto your portfolios! Adani Group shares staged a lively comeback on Tuesday, January 27, leaving last week’s jitters behind. The trigger? Adani Enterprises clarified it’s not part of any legal drama making the rounds in the media. Investors, who were biting their nails after the sell-off, quickly jumped back in, pushing stocks higher. It’s a classic case of “facts over fear” as confidence returned and optimism took the wheel.

If you were wondering whether it’s time to cheer or check your watch, yesterday proved the market can swing fast, and Adani’s fundamentals are still very much in the driver’s seat!

Adani Enterprises Is On A Clean Chit, Investor Confidence Restored

Adani Enterprises has put market speculation to rest, filing a statement with stock exchanges on January 24, 2026, confirming it faces no allegations and is not part of the reported legal proceedings. The BSE and NSE requested information about media reports which claimed that US regulators planned to use different methods for delivering legal documents to Gautam Adani and Sagar Adani.

The clean chit reinforces that the company’s leadership and core operations remain unaffected. The news brought a positive market reaction, which resulted in investors restoring their confidence. Adani Enterprises achieved two goals through its transparent handling of the situation because it reassured investors while proving its effective governance capabilities. The message is clear: despite media noise, Adani continues business as usual with integrity intact, turning uncertainty into optimism for shareholders.

“There are no allegations made against the Company in, and the Company is not party to, these proceedings,” the company said.

The US legal saga involving Gautam and Sagar Adani has been dragging on for over a year. The brothers’ lawyers made their first US court filing fourteen months after fraud-related charges were filed, which showed their intention to address the summons.

US Legal Proceedings: Adani Brothers Engage Strategically

The US Securities and Exchange Commission (SEC) wanted to deliver the summons through email and through the Adanis’ US-based legal counsel after India’s Ministry of Law and Justice denied this request two times. The ministry identified missing signatures and seals in May and mentioned internal SEC rules in December. The SEC dismissed both objections, which it considered baseless, while asserting that India’s objections served as obstacles to the regulator.

The legal process progresses through its various stages while the Adanis participate in it through their planned activities because the dramatic headlines create this illusion.

Adani Group Stocks Bounce Back After Positive Clarification

| Company | Stock Performance | Latest Price (₹) |

|---|---|---|

| Adani Green Energy | +6% | 818.45 |

| Adani Enterprises | +5.4% | 1,963.15 |

| Adani Energy Solutions | +4% | 847 |

| Adani Ports & SEZ | +4% | 1,362.90 |

| Adani Power | +3.4% | 137.60 |

| Adani Total Gas | +3.2% | 533.85 |

| Ambuja Cements | +3% | – |

| ACC | +1.6% | – |

| NDTV (Media arm) | +2.5% | – |

Background: Adani vs. US Regulator – Key Points

-

Volatility originates from November 2024, involving allegations related to electricity purchases from Adani Green Energy.

-

The SEC filed a civil case against Gautam and Sagar Adani; this is separate from the DOJ’s ongoing criminal proceedings.

-

US law restricts foreign companies raising capital from US investors from paying bribes or providing misleading disclosures.

-

The Adani Group has consistently rejected all allegations as baseless.

-

The company remains committed to pursuing all available legal remedies to protect its reputation.

-

Despite headlines, Adani’s core operations and leadership remain strong and unaffected.

(With Inputs)

Also Read: Axis Bank Share Price Soars After Q3 Results: Profit Growth, NII Rise, and Analyst Optimism

Aishwarya is a journalism graduate with over three years of experience thriving in the buzzing corporate media world. She’s got a knack for decoding business news, tracking the twists and turns of the stock market, covering the masala of the entertainment world, and sometimes her stories come with just the right sprinkle of political commentary. She has worked with several organizations, interned at ZEE and gained professional skills at TV9 and News24, And now is learning and writing at NewsX, she’s no stranger to the newsroom hustle. Her storytelling style is fast-paced, creative, and perfectly tailored to connect with both the platform and its audience. Moto: Approaching every story from the reader’s point of view, backing up her insights with solid facts.

Always bold with her opinions, she also never misses the chance to weave in expert voices, keeping things balanced and insightful. In short, Aishwarya brings a fresh, sharp, and fact-driven voice to every story she touches.