The Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025, was recently passed in the Parliament. The legislation amends three key Acts: The Insurance Act, 1938, The Life Insurance Corporation Act, 1956, and The Insurance Regulatory and Development Authority Act, 1999.

What Changes For Customers Under The New Insurance Rules

100% FDI in Insurance Companies

One of the most significant changes under the bill is the increase of Foreign Direct Investment (FDI) in insurance companies from 74% to 100%, opening doors for greater international participation.

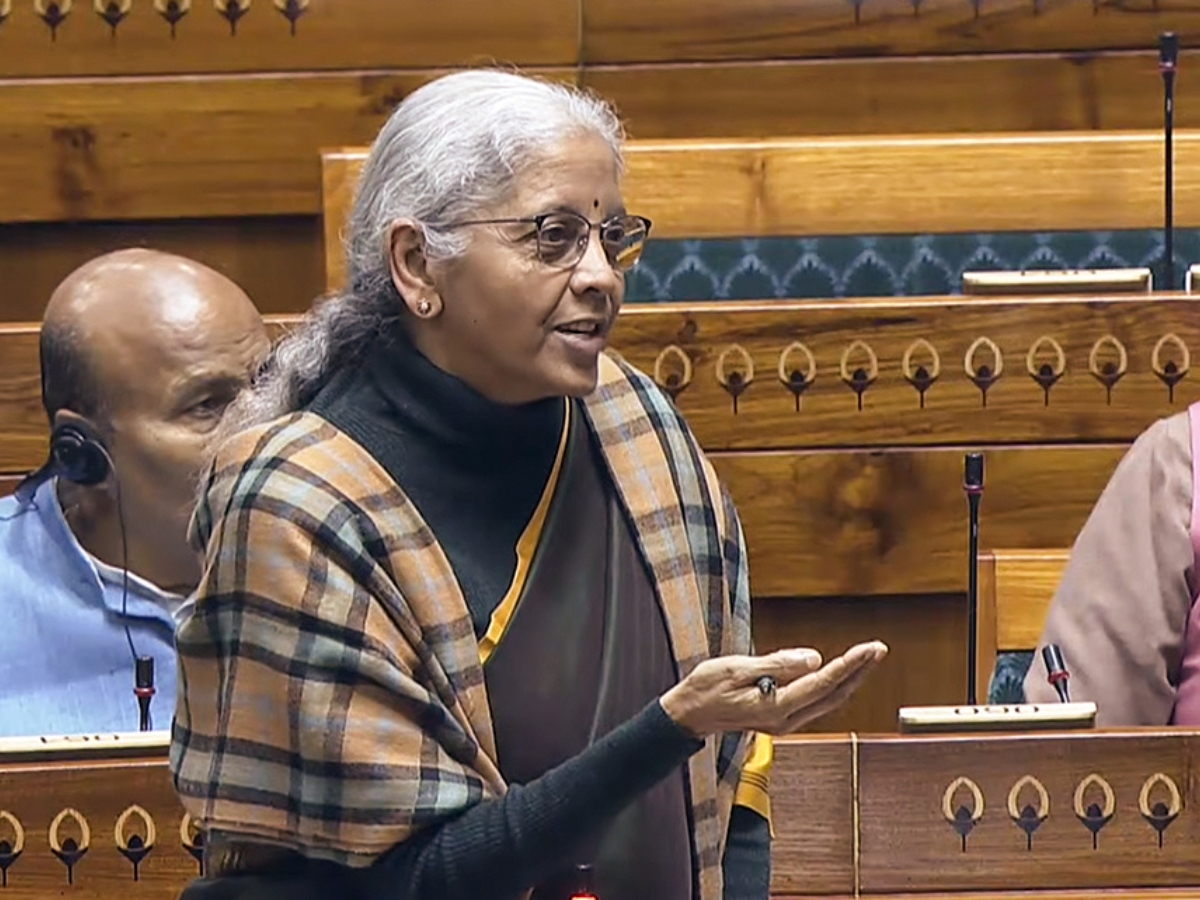

Finance Minister Nirmala Sitharaman expressed confidence that under the new rules, increased competition would benefit consumers by lowering premiums.

Enhanced Record-Keeping and Data Accuracy

The new insurance rules mandate insurers to maintain detailed and verified records of policyholders to prevent errors during claims.

Section 15, Clause 14(1)(a)(i) states, “…in respect of every policy issued by the insurer to an individual, the name, date of birth, address and (where available) email address of the policyholder, Aadhaar number or Permanent Account Number… and a record of any transfer, assignment or nomination…”

Insurers are now responsible for ensuring the accuracy, completeness, and security of all policyholder data.

Transparency in Claims and Digital Access

The bill introduces stricter requirements for claims transparency and digital record-keeping.

Section 15, Clause 14(1)(b) mandates, “…a record of claims… and the date on which the claim was discharged, or, in the case of a claim which is rejected, the date of rejection and the grounds thereof.”

Section 15, Clause 14(2) ensures, “Every insurer shall… endeavour to issue policies… in electronic form, in such manner and form as may be specified by the regulations.”

Data Privacy and Restrictions on Sharing

The new rules also strengthen data privacy protections, limiting how insurers can use or share policyholder information.

Section 15, Clause 14C(1), “…insurers and other regulated entities of the Authority shall ensure that the Know Your Customer (KYC) information of the policyholders… is maintained with utmost confidentiality and would be comprehensively protected.”

The only circumstances under which data may be shared are:

Disclosure required by law

Disclosure in the public interest

Disclosure with explicit customer consent

This provision effectively bans the unauthorised sale of policyholder information to third-party marketers.

Stricter Penalties for Non-Compliance

The rules introduce heavier penalties for insurers and intermediaries failing to comply with regulations:

Up to ₹1 lakh per day, capped at ₹10 crore

Unregistered insurance intermediaries: fines up to ₹1 crore

The amended Section 102 specifies that insurers failing to meet regulatory requirements will face penalties “up to one lakh rupees for each day during which such failure continues, subject to a maximum of ten crore rupees.”

Industry Response to New Insurance Rules

LIC CEO and MD R Doraiswamy welcomed the legislation, stating, “Insurance legislation passed by Parliament earlier this week is set to be a game-changer for the sector’s growth and help make insurance policies more accessible and affordable. By updating legacy provisions and strengthening governance norms, the amendments reinforce transparency, accountability, and prudential oversight across the insurance ecosystem. For policyholders, this translates into stronger safeguards, improved service standards, and enhanced confidence in long-term insurance commitments, an essential factor in a sector built on trust.”

Also Read: Gratuity Rules Revised: What Private Employees Need to Know After December 2025

Zubair Amin is a Senior Journalist at NewsX with over seven years of experience in reporting and editorial work. He has written for leading national and international publications, including Foreign Policy Magazine, Al Jazeera, The Economic Times, The Indian Express, The Wire, Article 14, Mongabay, News9, among others. His primary focus is on international affairs, with a strong interest in US politics and policy. He also writes on West Asia, Indian polity, and constitutional issues. Zubair tweets at zubaiyr.amin