Himachal Toll Tax Hike: The government led by Sukhvinder Singh Sukhu has announced a sharp increase in entry toll rates for vehicles entering Himachal Pradesh from neighbouring states. The revised rates, effective April 1 for the 2026–27 financial year, are aimed at strengthening state revenues amid ongoing financial pressure.

Under the new barrier policy, toll charges in several vehicle categories have been nearly doubled.

Himachal Toll Tax Hike: Steep Increase Across Categories

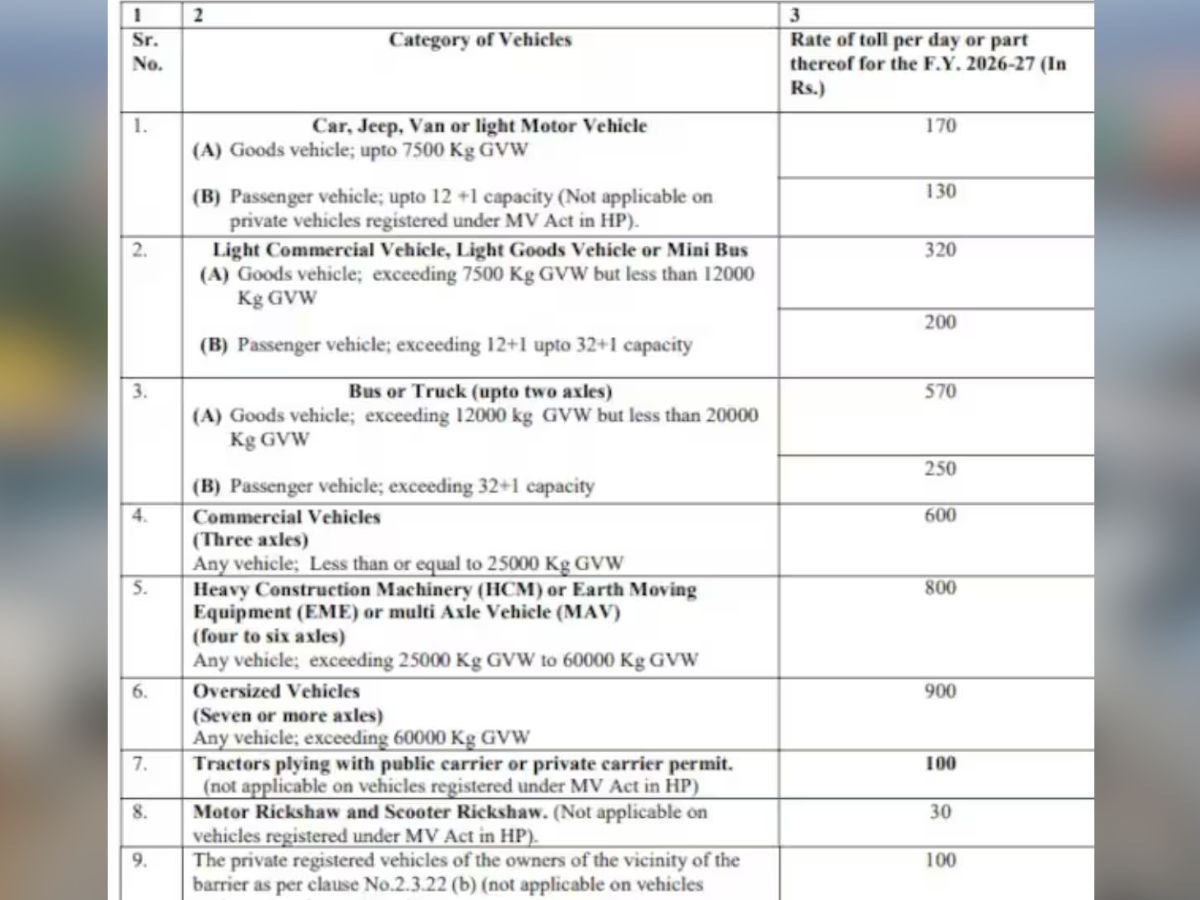

As per the notification, private vehicles arriving from states such as Punjab, Haryana, Uttar Pradesh and Delhi will now pay Rs 170 as entry tax, up from Rs 70 earlier. Vehicles carrying 12+1 passengers will also be charged Rs 170, compared to the previous Rs 110.

Heavy vehicles will see toll rates rise from Rs 720 to Rs 900. Construction machinery, including JCBs and similar equipment, will now attract an entry fee of Rs 800, up from Rs 570. Tractor entry tax has been increased from Rs 70 to Rs 100.

However, the toll for double-axle buses and trucks remains unchanged at Rs 570. Officials clarified that vehicles registered within Himachal Pradesh will continue to be exempt from the entry tax.

FASTag Rollout, Online Auction Process Planned

Entry tax barriers are located at Govindghat (Sirmaur), Kandwal (Nurpur), Mehatpur (Una), Baddi, Parwanoo, and near Garamora in Bilaspur district.

To streamline toll collection and reduce manual processing, the government will introduce FASTag systems at all entry barriers. Authorities said this move is expected to enhance transparency and improve revenue monitoring.

A committee headed by the respective Deputy Commissioners has been constituted to oversee the auction process for the toll barriers. Officials from the Excise and Taxation Department will serve as members.

The auction will be conducted online, with the base bid for a single toll barrier fixed at Rs 5 crore. Prospective bidders must deposit a non-refundable fee of Rs 25,000 to participate.

The revised toll structure signals the state government’s push to boost income while maintaining exemptions for local vehicles.