Financial experts emphasize that regular investment can generate substantial returns over time. Investors today have multiple options in the market, but all carry some level of risk. Government schemes, bonds, and bank deposit schemes stand out as safer instruments offering guaranteed returns. These options attract risk-averse investors who seek steady growth over speculative gains. Fixed deposits remain one of the most trusted instruments, combining security with predictable earnings. Investors looking for stability often prefer instruments that are virtually risk-free, ensuring that their principal and returns remain protected.

Bank Fixed Deposits Remain Popular Among Investors

Fixed deposits (FDs) are one of the first investment choices for many Indians. Banks currently offer attractive FD interest rates, and senior citizens benefit from higher rates. Families can open FD accounts in the name of elderly members to access these advantages. Interest rates differ from bank to bank, giving investors flexibility to choose according to their financial goals. The secure nature of FDs, combined with fixed returns, makes them a preferred option among conservative investors. Banks continue to promote FDs as a long-term wealth-building tool.

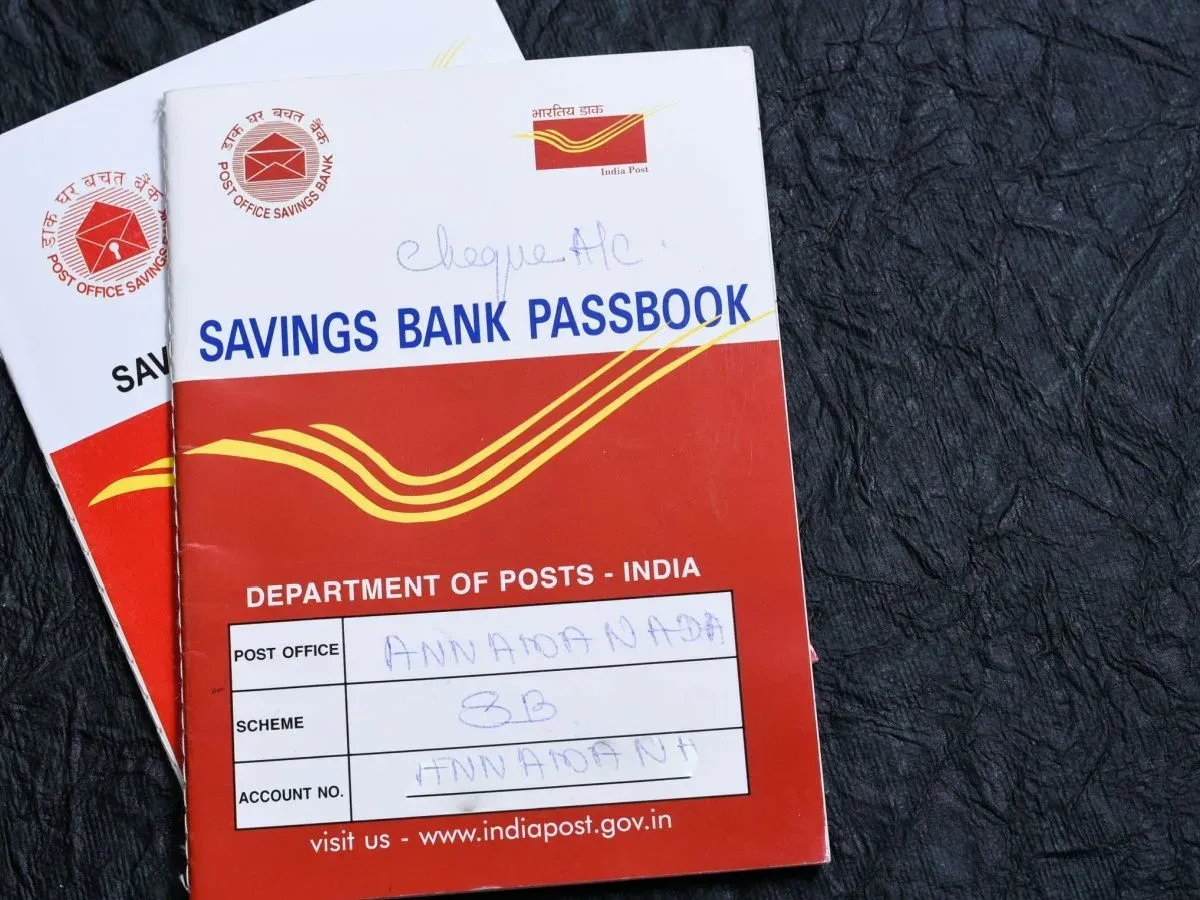

Post Office FDs Maintain Higher Rates Despite RBI Repo Cuts

The Reserve Bank of India (RBI) reduced the repo rate by 1% this year, prompting most banks to lower FD interest rates. Post Office fixed deposits, however, remained unaffected, continuing to offer higher rates than many banks. Investors seeking stability and better returns often turn to Post Office FDs, which are unaffected by market fluctuations. These deposits provide guaranteed interest, making them a reliable investment option for those who prefer low-risk instruments. Post Office FDs also allow long-term planning, helping investors secure consistent returns over fixed tenures without worrying about sudden interest rate changes.

Post Office FD Terms and Interest Rates

Post Office Fixed Deposits, also called Time Deposits (TDs), offer guaranteed returns over fixed tenures. Investors can select from four terms: 1, 2, 3, or 5 years. Currently, the Post Office offers 6.9% interest for a 1-year TD, 7.0% for 2 years, 7.1% for 3 years, and 7.5% for 5 years. The minimum deposit is Rs 1,000, with no upper limit, allowing investors to deposit according to their financial capacity. These TDs suit both small and large investors, making Post Office FDs a flexible and dependable investment option for everyone.

Example: Returns on a Rs 1 Lakh Post Office FD

If an investor opens a Post Office FD of Rs 1 lakh in the name of a spouse for 24 months, the returns remain higher than many bank FDs. The guaranteed interest ensures steady growth without market exposure. Post Office FDs allow families to plan for future expenses, such as education, retirement, or emergencies. With predictable returns and government backing, these deposits remain one of the most secure savings instruments in India. Investors looking for low-risk yet profitable options often prioritize Post Office TDs over other deposit schemes.

Swastika Sruti is a Senior Sub Editor at NewsX Digital with 5 years of experience shaping stories that matter. She loves tracking politics- national and global trends, and never misses a chance to dig deeper into policies and developments. Passionate about what’s happening around us, she brings sharp insight and clarity to every piece she works on. When not curating news, she’s busy exploring what’s next in the world of public interest. You can reach her at [swastika.newsx@gmail.com]